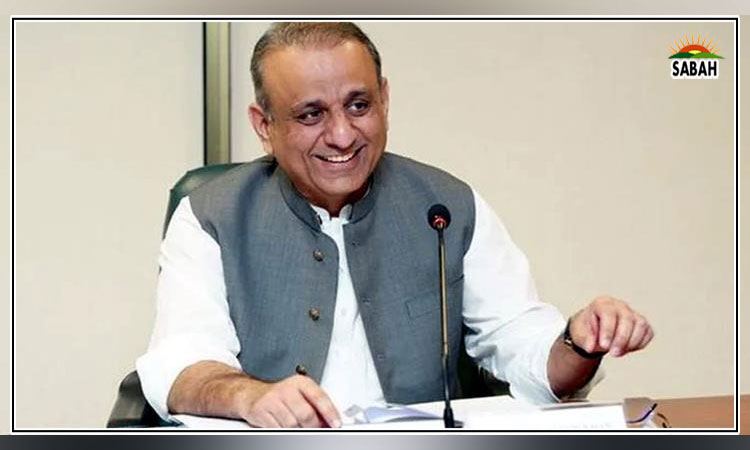

Saudi Arabia, United Arab Emirates & Qatar will make big investment in Pakistan: Dr. Ali Awadh Asseri

RIYADH, July 26 (SABAH): Former ambassador of Saudi Arabia to Pakistan Dr. Ali Awadh Asseri has said that Prime Minister Shehbaz Sharif of Pakistan is nearing the end of a challenging yet fruitful tenure, marked by major policy decisions. One of his strategic moves was to deepen investment and trade ties with Saudi Arabia, the UAE and Qatar. These leading economies of the Gulf Cooperation Council (GCC) have also demonstrated a willingness to contribute to Pakistan’s economic stability and revival. He said Saudi Arabia, United Arab Emirates (UAE) and Qatar will make big investment in Pakistan.

In an article published in “Arab News”, Dr. Ali Awadh Asseri wrote that Pakistan has always prioritized economic, defense and cultural relations with the Kingdom and other Gulf nations. This historically rooted relationship is based on the common bonds of religion and culture, mutually beneficial economic needs and shared strategic interests in regional stability and global peace.

Dr. Ali Awadh Asseri wrote that the GCC region plays a crucial role in Pakistan’s economy, serving as the primary source of energy imports and foreign remittances. It is also home to the largest number of Pakistani expatriate workers. The ongoing economic diversification and regional reconciliation in the Gulf, particularly under the Saudi Vision 2030, offer ample opportunities for Pakistan to attract GCC investments in the development sector, as well as to export skilled manpower and tradable commodities to the Gulf nations.

He further wrote that Pakistan’s civilian and military leaders understand the vital role GCC investments can play in putting the crisis-ridden economy on a steady course toward sustainable progress. Among the major policy initiatives to this end is the establishment of the Special Investment Facilitation Council (SIFC), which is tasked with attracting foreign direct investment from GCC countries in the fields of agriculture, minerals and mining, information technology, and defense production. This important step is being complemented by the launch of the Pakistan Sovereign Wealth Fund and the conclusion of the Comprehensive Economic Partnership Agreement with the UAE. The current civil-military consensus on the GCC’s pivotal economic role has emerged against the backdrop of tangible progress made by the present government on the economic, political, security and foreign policy fronts.

Sharif faced significant challenges upon taking office in April last year, inheriting a country on the verge of financial default. Dealing with the subsequent political turmoil, a renewed wave of terrorism and a serious deterioration in Pakistan’s relations with major powers and trusted allies was also a daunting task. But he has been able to successfully navigate this complex landscape by engaging coalition leaders, the security establishment and key foreign partners.

As a result, Pakistan is now stable enough to transition smoothly toward a caretaker setup, which will hold the next general election. Political turmoil has receded since the appointment of Gen. Asim Munir as the Chief of the Army Staff in November. A new staff-level agreement with the International Monetary Fund, worth $3 billion for a period of nine months, was concluded in June. Although terrorism has seen a resurgence, enhanced security structures are now in place to combat this threat. And the China-Pakistan Economic Corridor stands revived, while relations with the US are also back on track.

Most notably, the civil-military collaboration has expanded to the economic sphere, giving renewed momentum to Pakistan’s economic partnership with the leading GCC economies. Since 2019, Saudi Arabia, China and the UAE have offered concessional loans worth several billion dollars to shore up Pakistan’s foreign reserves. These loans have subsequently been rolled over to meet the IMF demand. The latest IMF deal became possible after Saudi Arabia deposited an additional loan of $2 billion in the State Bank of Pakistan.

Dr. Ali Awadh Asseri further wrote, the Kingdom has always stood by Pakistan through thick and thin. But Pakistan must stand on its own two feet. The Special Investment Facilitation Council offers a viable pathway in this respect. Its establishment indicates that Pakistan’s civilian and military leaders understand the risk of dependency on foreign loans. And they are preparing to lay down a solid economic base through attracting investment from friendly countries. Thus far, Pakistan’s inability to provide a swift, one-window operation to foreign investors is the key reason for the extremely low levels of investment inflows. There are unnecessary bureaucratic hurdles and regulatory requirements, which discourage investors and disrupt the initiation of new projects and the completion of existing ones. Political instability results in frequent changes of government and the consequent lack of continuity in economic policies.

These issues have plagued major investment commitments by Saudi Arabia, the UAE and Qatar in the recent past. While visiting Islamabad in 2019, Crown Prince Mohammed bin Salman pledged $20 billion of investment in the energy, minerals and mining sectors. Likewise, the UAE and Qatar have committed $9 billion. But these pledges are yet to materialize due to cumbersome procedures and structural impediments.

Foreign investors need a guaranteed return on their investments. The Special Investment Facilitation Council is envisaged to offer one-window services through technocratic consultation and institutional facilitation. The inclusion of the army chief in its apex committee, and of top military officials in the executive and implementation committees, is important for guaranteeing continuity, transparency and accountability.

Dr. Ali Awadh Asseri wrote that the Pakistan Sovereign Wealth Fund is also envisioned to be free from bureaucratic and regulatory hassles. For now, at least seven state assets worth 2.3 trillion rupees ($8 billion) are being transferred into this fund and are expected to expand through the sale of shares and the use of their earnings for capital investments. The government also plans to undertake joint ventures with GCC companies, while privatizing and leasing out the loss-making public sector enterprises.

Dr. Ali Awadh Asseri wrote that tangible progress in this investment drive will help Pakistan to increase investment inflows from the GCC, China and other countries. But its aspiration to become a $1 trillion economy by 2035 will depend on it taking solid steps that boost the dismal level of bilateral trade, which is currently worth $3 billion annually with the Gulf states. Islamabad must also increase the number of Pakistani workers and the diversity of the jobs they do in the GCC region. They number about 4 million at present. Going forward, the Comprehensive Economic Partnership Agreement with the UAE needs to be emulated in Pakistan’s trade links with Saudi Arabia and the other GCC members. Pakistan’s skilled manpower in the IT and services sectors is a perfect match for the economic transformations taking place in the Gulf, particularly Saudi Arabia.

Let me conclude by saying that Sharif has done well to raise the prospects of economic recovery in Pakistan. One hopes that its future political leadership will sustain the current momentum in economic policies, especially with respect to the rapidly evolving partnership with the GCC economies.

It is worth mentioning here that Dr. Ali Awadh Asseri served as Saudi Arabia’s ambassador to Pakistan from 2001 to 2009 and received Pakistan’s highest civilian award, Hilal-e-Pakistan, for his services in promoting the Saudi-Pakistan relationship. He also served as the Saudi ambassador to Lebanon from 2009 to 2017. He holds a Ph.D. in Economics from Beirut Arab University and authored the book, “Combating Terrorism: Saudi Arabia’s Role in the War on Terror” (Oxford, 2009). He is a member of the Board of Trustees at RASANAH, the International Institute for Iranian Studies, Riyadh. The article reflects his personal views.