Rs 647 miln POS collected as Rs .01 / per invoice for the financial year 2023-24: Senate Finance Committee

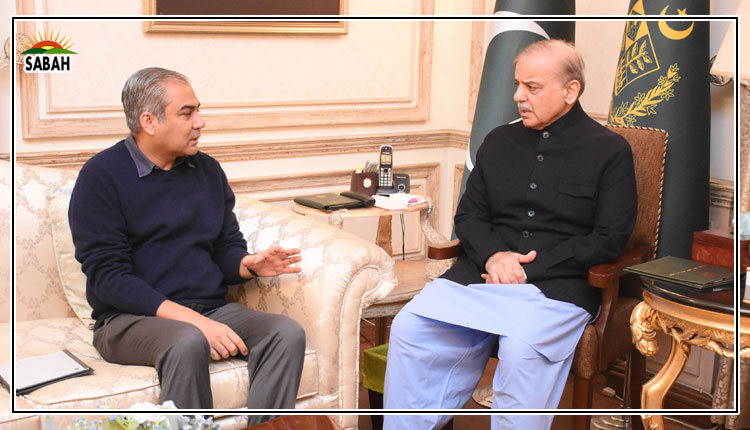

ISLAMABAD, Oct 09 (SABAH): A meeting of the Senate Standing Committee on Finance and Revenue was convened on Wednesday under the chairmanship of Senator Saleem Mandiwalla at the Parliament House.

The meeting included the participation of Senators Farooq Hamid Naek, Sherry Rehman, Anusha Rahman Ahmad Khan, and Shazaib Durrani. Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb, along with senior officials from related departments, also attended.

The committee unanimously approved, with amendments, the Government Bill titled “The Banking Companies (Amendment) Bill, 2024,” which was referred by the House on August 27, 2024.

Agenda items included discussions related to the Federal Board of Revenue (FBR). The matter raised by Senator Manzoor Ahmad was deferred up till his satisfaction due to his absence. The matter pertained to concerns about a 10% levy on transport and business operations between Pakistan and Iran. It was reported that when Pakistani vehicles transporting cargo from Quetta to Iran reach their destination, Iranian authorities deduct 10% of the fare as an additional fine. In contrast, Iranian vehicles transporting goods from Quetta to Iran incur no such charges. This practice disregards the principle of reciprocity and results in unequal treatment for Pakistani vehicles. The FBR informed the committee that this issue has been communicated to the Ministry of Communications, which is the designated authority for implementing the Bilateral Road Transportation of Goods Agreement. It was recommended that the Ministry of Communications, in coordination with the Ministry of Foreign Affairs, address this matter with Iranian authorities. The discussion was deferred upon request of Senator Munzoor Ahmad.

Senator Mohsin Aziz initiated a query regarding the amount collected by the FBR up to July 2024 through a Rs 1 fee on each invoice related to point-of-sale (POS) services, along with details on its utilization. The committee was informed that the former Finance Minister approved the use of this revenue for funding the monthly price scheme for customers at integrated Tier-I retailers, enhancing the capacity of POS-related technical and logistical teams, media campaigns, and employee welfare for the IRS. The total POS fee collected amounted to Rs 647,319,302, with Rs 309,337,000 utilized primarily for employee welfare.

The committee also examined the legal basis for provinces imposing taxes on exports. It was clarified that provinces have the constitutional authority to levy an Infrastructure Development Cess on the transportation of goods for imports and exports. However, to promote exports and facilitate the flow of foreign exchange, such duties and taxes are generally not imposed on exports. The Khyber Pakhtunkhwa province, which shares a border with Afghanistan and has substantial export activities, may see a negative impact on exports due to a proposed 2% Infrastructure Development Cess. It was noted that Pakistan Customs is not currently collecting this cess; rather, banks are handling it on behalf of the provincial government. It was decided that MOF ll constitute a committee to finalise a recommendation for the committee to resolve this issue

The committee addressed an issue regarding an illegal demand for payment of Rs 603,248,425 under Islamic Finance prior to the delivery of an asset (vehicle) by Faysal Bank Ltd. The matter was resolved by the bank.

Additionally, the committee received a comprehensive briefing from the Karakoram Initiative on the concept of a “National Tax Authority.”

The committee also heard from the Country Director of the Asian Development Bank (ADB) about the bank’s projects in Pakistan and its role in the country’s socio-economic development. It was reported that ADB’s recent support for Pakistan included $802 million, $500 million for COVID-19 vaccines in 2020 and 2021, and $1.5 billion in commitments for recovery efforts from the 2022 floods.