Pakistan had given a ‘clear message’ to IMF about the country’s desire to complete ninth review of IMF programme: PM Shehbaz

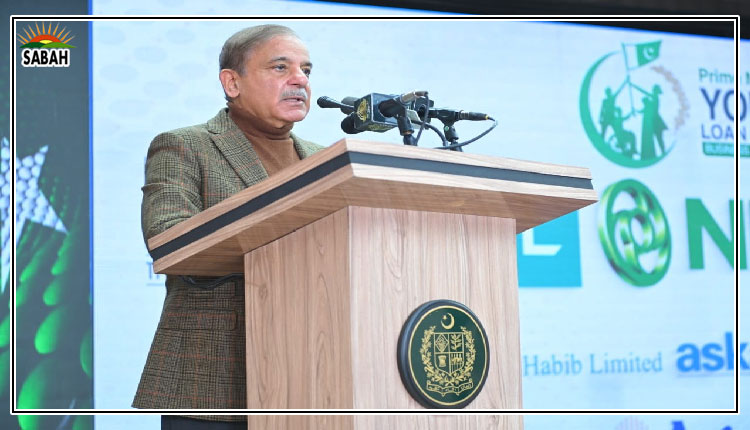

ISLAMABAD, Jan 24 (SABAH): Prime Minister Mian Muhammad Shehbaz Sharif said on Tuesday that Pakistan had given a “clear message” to the International Monetary Fund (IMF) about the country’s desire to complete the ninth review of the $7 billion Extended Fund Facility (EFF).

Addressing the launch of ‘Youth Business and Agricultural Loan Schemes’ in Islamabad, PM Shehbaz Sharif reiterated the government’s desire to complete the review. “We have given the IMF a clear message that we want to complete the ninth review. We are ready and want to sit down regarding your conditions so that it can be concluded and Pakistan can move forward.”

He stated that Pakistan had been “given a clear message left and right” that the country would not be abandoned but that it was necessary for it to “stitch” the IMF programme.

PM Shehbaz Sharif said that the government had written to the international money lender. “I spoke to the IMF managing director two weeks ago and we have proactively approached them that we want to complete the ninth review without delay so that the programme moves forward, in addition to other multilateral and bilateral programmes.” PM Shehbaz Sharif said that we should have to move forward while learning lesson from the past.

PM Shehbaz Sharif announced loan and laptop programmes for youth in an initiative aimed at promoting self-employment and entrepreneurship. He said the people in the age bracket of 21 and 45 years could avail themselves of the loan facility of up to Rs7.5 million under these schemes. For IT and E-commerce businesses, the lower age limit is 18 years.

The prime minister said Pakistan was passing through difficult times and resolved that he would sacrifice all his political career and life for the sake of the country.

“I have served thrice as a chief minister of Punjab and now serving as a prime minister of the country. What legacy we will leave behind if these issues are not addressed? It is clear that Pakistan is facing huge challenges, and if we have taken responsibility, we will make our last-ditch efforts to steer the country out of the difficulties,” he stressed.

The prime minister said it was their collective responsibility as Pakistanis, politicians and Muslims to respond to the difficult situation, and he would not even desist from sacrificing his life for the country. He said in this path, problems would spring up but they would have to bear the pain. The people at the helm of affairs, politicians and the rich had to set an example as it was unfair to burden the poor with price hike and let the rich and elite enjoy country’s loans, he added.

Under the programme, youth would be extended loans upto Rs7.5 million on easy installments and soft interest rates. Up to Rs500,000 loan amount would be interest-free, he said.

The prime minister, expressing his optimism, said the youth had the potential and talent and together they would steer Pakistan out of the current issues. He praised them as “the shining stars on the horizon of the country”. He said the prime responsibility of addressing the country’s issues rested with the government. They took reigns of the government under the most difficult times but despite all these ordeals, their resolve grew stronger to make Pakistan stronger, he added.

Speaking on the occasion, State Bank of Pakistan (SBP) Governor Jameel Ahmad lauded the coalition government for launching the initiative of the easy loan programme for youth. “The government is committed to empowering the youth despite financial issues.”

The governor added that special instructions had been issued to the banks for issuing loans to the youth.

Provision of loans to the “agriculture sector is the top priority” of the government and the central bank, he added. The SBP governor said that every possible assistance would be provided to farmers in flood-hit areas. “The limit of agricultural loans has been increased by 44%.”

He urged all institutions to play a positive role in connection with the youth loan scheme.

It is worth mentioning here that the loan schemes are aimed at promoting self-employment and entrepreneurship amongst the youth.

People in the age group of 21 and 45 years can avail of the loan facility of up to Rs7.5 million under these schemes. For IT and E-commerce businesses, the lower age limit is 18 years.

Micro-financing through small business loans will promote a norm of job creation rather than job seeking among the country’s youth bulge.

The addition of agricultural loans will help the rural youth in bringing innovation to farming which can include mechanised farming, the creation of agricultural value chains and the solarisation of farming equipment to create more sustainable energy resource management in a climate-challenged country like Pakistan.

Under the schemes, loans of up to Rs1.5 million can be availed on the personal guarantee of the borrower.

According to the details, there will be no interest rate on the loan of up to Rs0.5 million. 5% interest will be charged on the loan of over Rs0.5 million to 1.5 million. 7% interest rate will be charged on the loan of over Rs1.5 million to Rs7.5 million.

25% quota has been reserved for women. Islamic banking facilities can also be availed on the loan scheme.