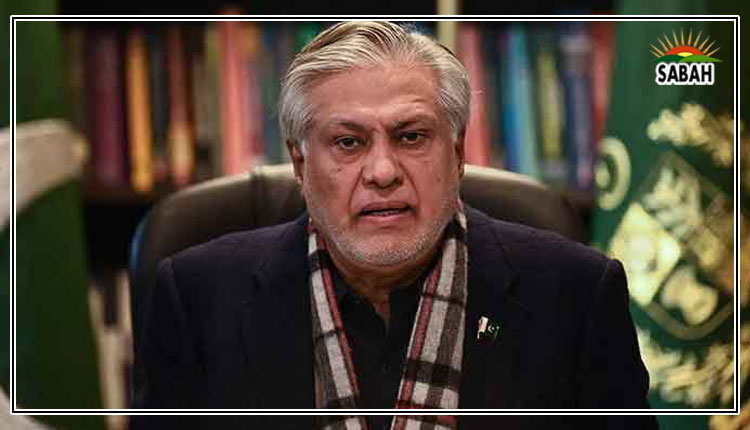

Pakistan fulfilled all conditions of IMF for release of $1.1 billion tranche: Ishaq Dar

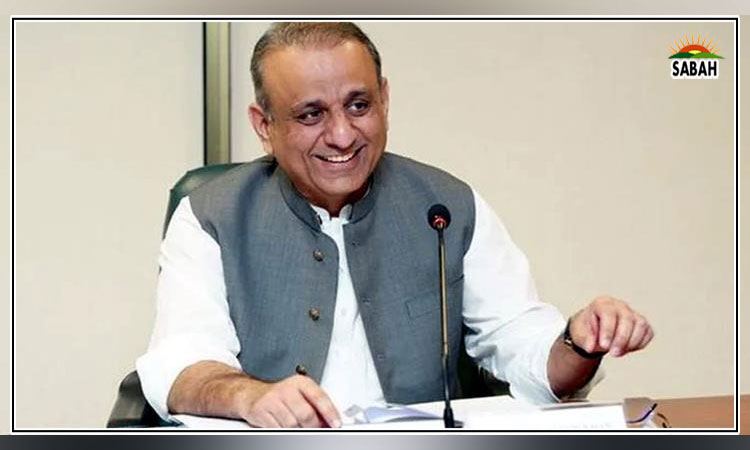

LAHORE, April 24 (SABAH): Pakistan has fulfilled all the conditions of the International Monetary Fund (IMF) for the release of the $1.1 billion tranche, Finance and Revenue Minister Senator Ishaq Dar said on Monday, hoping the Fund will soon sign the staff-level agreement.

Both sides have been engaged in multiple talks since February to break impasse on the pending ninth review of the Extended Fund Facility (EFF) of the bailout package at a time when the timeframe of the 10th review is in sight.

The global lender has placed multiple conditions that include domestic revenue generation from taxation and tariffs, waiving subsidies and external financing from friendly countries.

He told media that both Saudi Arabia and the United Arab Emirates (UAE) had informed the IMF about their commitments to provide $3 billion to Pakistan. Riyadh will provide $2 billion while Abu Dhabi has promised $1 billion to Pakistan, Dar said, adding that the Washington-based lender has also been informed in this regard.

The finance minister said all the conditions for the staff-level agreement between Pakistan and IMF have been fulfilled, adding Pakistan was hopeful that Fund would soon sign the SLA and get it approved by its Executive Board.

The country’s foreign exchange reserves have fallen to cover barely a month of imports after the IMF funding stalled in November, hit by snags over fiscal policy adjustments after officials of the lender visited Islamabad in February for talks.

They formed part of a ninth review exercise on a bailout package of $6.5 billion agreed upon in 2019 whose resumption is critical for Pakistan to avoid risking default on external payment obligations.

Pakistan had to complete actions demanded by the IMF, such as reversing subsidies in its power, export and farming sectors, hikes in the prices of energy and fuel, and a permanent power surcharge, among other measures.

The IMF programme will disburse another tranche of $1.4 billion to Pakistan before it concludes in June this year.

Though the International Monetary Fund (IMF) has welcomed bilateral assistance confirmation to Pakistan but sought further assurances to seal the deal with the Shehbaz-led government.

The Pakistani delegation and IMF staff reached an agreement to maintain strong policies and secure sufficient financing to support the implementation efforts.

“The IMF is supporting these efforts and looks forward to obtaining the necessary financing assurances as soon as possible to pave the way for the successful completion of the 9th External Fund Facility review,” an official statement said.

Welcoming the commitments made by the Pakistan’s friendly countries helping the cash-strapped country revive the much-needed loan programme, IMF Mission Chief for Pakistan Nathan Porter said that Islamabad and global lender had agreed to continue the ongoing economic policies in the recent meetings. Both sides had also agreed to arrange adequate funds to implement these policies.

He said the IMF backed the efforts being made by the Pakistani officials to secure the financial assurances from friendly states as they will help it complete the ninth review under the Extended Fund Facility (EFF).

A day earlier, Dar confirmed that the United Arab Emirates agreed to financial support of $1 billion to Pakistan, removing a key hurdle to securing a much-awaited bailout tranche from the IMF. The commitment is one of the IMF’s last requirements before approving a staff-level pact to release a tranche of $1.1 billion, delayed for months, that is crucial for Pakistan to resolve an acute balance of payments crisis.

“The State Bank of Pakistan is now engaged for needful documentation for taking the said deposit from UAE authorities,” Finance Minister Ishaq Dar said on Twitter, referring to the central bank.

The pledge makes the UAE the third country, after Saudi Arabia and longtime ally China, to come to Pakistan’s assistance, as external financing is needed to fully fund the balance of payments gap for the fiscal year that ends in June.

“The UAE deal should be helpful because the IMF has been saying Pakistan should secure financing from ‘friendly’ nations,” said Seaport Global EM credit analyst Himanshu Porwal.

“It is still far from over though. The IMF is saying that they (Pakistan) are in breach of certain targets. The fiscal deficit for example is seen peaking at around 8.3% (of GDP), so almost double what they were expecting,” he added.

Pakistan’s bonds, which have slumped nearly 70% over the last year as the country’s troubles have mounted, climbed for a second day running on the confirmation. The rise was almost 5% for its bond with closest payment date – April 15 next year – taking it to almost 50 cents in the dollar, compared to 46 cents a few days ago.