Our capricious tax policy… SHAZIA TASNEEM FAROOQI

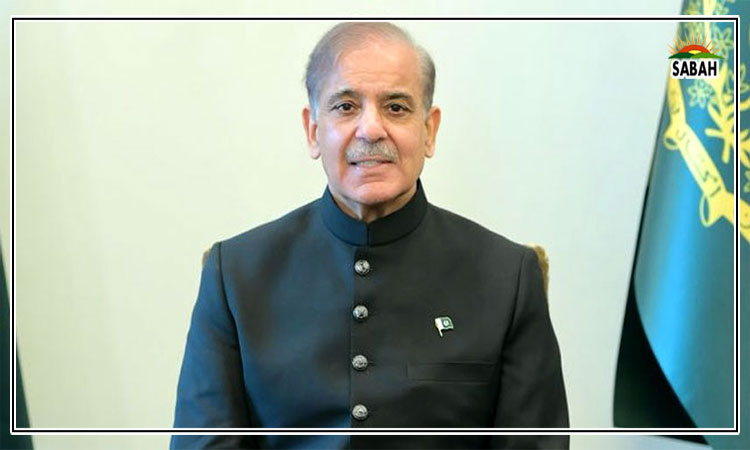

The government’s recent initiative following Prime Minister Shehbaz Sharif’s directive to ensure effective and swift taxation, along with strict measures for revenue collection, has caused great anxiety among the people. Many fear that FBR’s actions could involve harsh measures, potentially putting people from all segments of society in a difficult situation. When new or stricter taxation measures are introduced, the public often experiences a mix of concern and uncertainty, worrying about increased financial burdens, especially when the tax system is seen as inefficient or complex.

The fear of “wild measures” by tax authorities, like aggressive audits, fines or asset seizures, can lead to a loss of trust in the system. Anxiety increases when the government fails to communicate clearly about the specifics of tax reforms and their impact on different segments of society. Additionally, many citizens may feel the weight of paying taxes without seeing corresponding improvements in public services, which further fuels discontent.

Therefore, it is important for authorities to focus on transparency by providing fair, progressive tax policies that encourage compliance without causing undue hardship. It could also consider incentivising voluntary compliance through tax relief for timely payers or introducing flexible payment plans for those facing financial difficulties.

While the idea of implementing a “revenge collection” strategy for tax enforcement may seem like an immediate solution to address non-compliance, it risks creating a climate of fear and mistrust between taxpayers and authorities. Such aggressive tactics may force compliance in the short-term, but they can also lead to resentment and discourage voluntary participation in the tax system. Therefore, more people-friendly approach would be far more effective in the long run. By focusing on taxpayer education, offering incentives for timely payments, and providing flexible payment options, the government can encourage a culture of cooperation and trust.

Besides, transparent communication and accessible resources for taxpayers to resolve issues would further foster higher compliance rates and a healthier economy.

Essentially, a “revenge collection strategy” is an attempt to create fear or pressure among taxpayers to comply with tax laws through severe measures, with the intention of reducing tax evasion and increasing compliance. However, such an approach can have negative side effects, such as fostering resentment or damaging public trust in tax authorities if perceived as unjust or overly harsh.

Pakistan’s tax system has long been a critical and yet complex subject of debate. Despite its potential to drive growth and ease fiscal pressures, the country’s tax system remains underutilised. The core issue lies not just in the structural setup but in the way policies have been implemented, combined with entrenched challenges such as low tax compliance, tax evasion and reliance on traditional revenue sources.

Pakistan’s current tax base is overly reliant on a few sources. A significant portion of national revenue comes from sales tax, income tax and customs duties. While these taxes make up the bulk of the revenue stream, they often fail to generate sufficient income to cover the country’s needs. Pakistan’s tax-to-GDP ratio, a key metric for assessing a country’s tax revenue in relation to its GDP size, slightly rose up to 8.77% in FY24 from 8.54% in the previous fiscal year, according to FBR.

According to the World Bank, tax revenues that exceed 15% of a country’s GDP are crucial for fostering economic growth and reducing poverty. In a stark contrast, Pakistan’s tax-to-GDP ratio has also remained significantly lower than the country’s capacity, which is estimated at 22.3% of GDP, according to World Bank.

However, a key reason for stagnation is Pakistan’s large informal economy, where businesses and individuals avoid taxation through lack of registration or off-the-record operations. Estimates suggest 70-80% of economic activity goes untaxed, and the challenge of formalising this sector worsens the revenue shortfall.

Overburdened compliance system is hindered by bureaucracy, complexity and inefficiency, with poor coordination between federal and provincial authorities. Frequent changes in tax policies, such as varying sales tax rates and inconsistent exemptions, create confusion for taxpayers, particularly SMEs. The lack of clarity and predictability lead many to avoid formal compliance, as the costs often outweigh the benefits.

Despite having legal frameworks for tax collection, enforcement mechanisms often fall short. Corruption within the tax administration makes it easier for businesses to bypass the system rather than comply with regulations.

Tax culture of evasion remains a deep-rooted issue in Pakistan. While the government’s efforts to digitise the tax system, such as linking Computerised National Identity Cards (CNIC) and mobile SIM cards with tax collection, may deter some evaders, these measures could have several negative impacts

First, it may raise significant privacy concerns, as individuals’ personal and financial data would be linked to their SIM cards and CNICs, making it more vulnerable to misuse, data breaches or unauthorised access. This could lead to identity theft and fraud if security measures are not properly enforced by telecom companies or government agencies. The policy may also disproportionately affect low-income or rural individuals, who rely on mobile phones for communication but may not be registered as taxpayers or aware of tax requirements. As a result, they could be unjustly penalised, potentially losing access to essential services that are critical for their daily life, such as mobile banking or communication.

Instead of harsh measures or “revenge collection” strategies, the government should adopt people-friendly approaches to improve tax collection. Simplifying the tax system and offering clear registration and filing processes can encourage compliance. Public awareness campaigns can build trust, while incentives for timely payments, like rebates or recognition, promote a culture of compliance. Flexible payment plans for those facing financial hardship would ease the burden. Utilising technology for efficient, transparent tax collection and expanding the tax base by formalising the informal economy can improve fairness. Fair audits, with support and guidance, would reassure taxpayers and foster trust in the system.

COURTESY ![]()