Ishaq Dar says Pakistan could become interest-free in five years

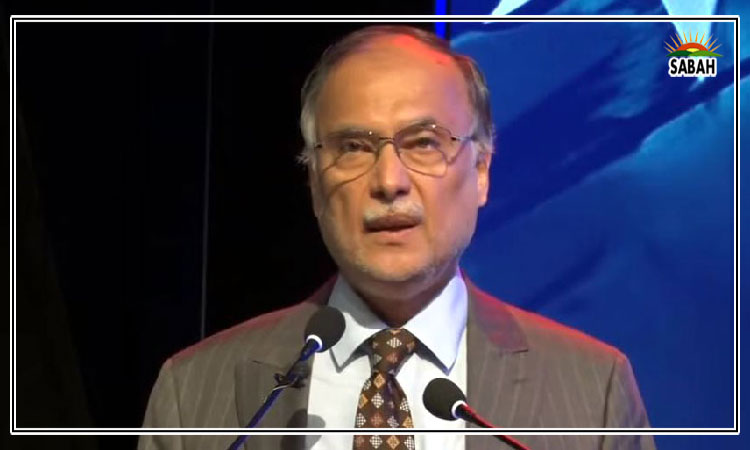

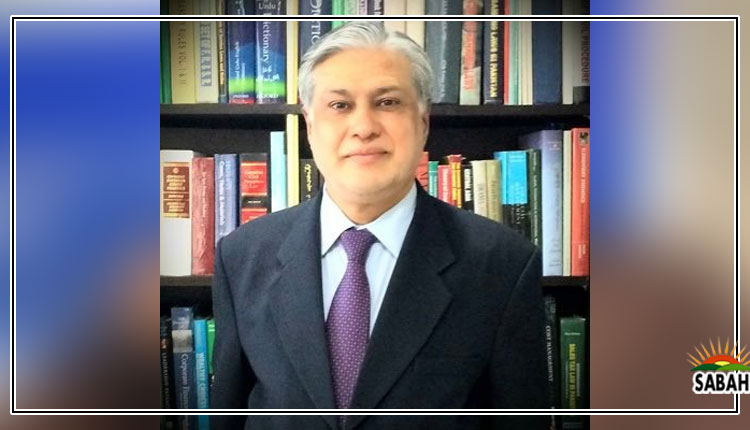

KARACHI, Nov 30, (SABAH): Minister for Finance and Revenue Senator Mohammad Ishaq Dar on Wednesday said that Pakistan could become interest-free in five years as he urged the banking sector to move towards and promote Islamic banking.

Ishaq Dar expressed the views while addressing a seminar at the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in Karachi where speakers spoke at length about interest-free banking.

In April, the Federal Shariat Court (FSC) had declared the prevailing interest-based banking system as against the Sharia and directed the government to facilitate all loans under an interest-free system.

The court had ruled that the federal government and provincial governments must amend relevant laws and issued directives that the country’s banking system should be free of interest by December 2027. Commercial banks and the central bank had subsequently filed an appeal before the Supreme Court (SC) challenging the FSC verdict.

However, earlier this month, Ishaq Dar announced the government would be withdrawing the State Bank (SBP) and National Bank’s (NBP) appeals against the FSC’s directives and would “try to as quickly as possible implement an Islamic system in Pakistan”.

Speaking during Wednesday’s seminar, Finance Minister Ishaq Dar said his government was working on converting the existing banking system to an interest-free one. “Our government has an interest in Islamic banking […] I will not say that we have achieved it.” He recalled that Meezan Bank had only 100 Islamic banking branches in 2013-2017 which had now increased to 1,000.

Ishaq Dar said that the assets of Islamic banks as of September 2022 were Rs7 trillion while their deposits were at Rs5tr. “So a base has been created [and] we have to make this a successful system.”

The minister said that in addition to Islamic banking, mutual funds, capital funds and insurance businesses should also be promoted on an “Islamic funds”.

Ishaq Dar called on the central bank and the Securities and Exchange Commission of Pakistan (SECP) to work in this regard in a “positive” manner. “This is not something that cannot be done within five years. It can be done within five years.”

The finance minister went on to say that the government should have been “walking down this path” even before the FSC’s verdict in April.

“The losses incurred by the country of that are in front of us. Every person is crying that the inflation has reached the sky.”

The minister said he had been informed about issues being faced in opening Islamic bank accounts and said he had directed officials to investigate the branches that were refusing to do so.

The financial czar said that the government aimed at abolishing the prevailing interest-based system in the country. “If we sincerely decide only to please the Almighty then in five years riba can be eliminated from the country and it can be replaced by a system based on Zakat and Ushr,” he added.

Ishaq Dar said that he had instructed the secretary finance to first seeks loans on Islamic Sukook Bonds and only take interest-based loans when there is no other option.

“I wish that Allah grants me powers so I could eliminate interest in a week or a month but a state has [to conduct] its business and interest-bases system has been in place for the past 75 years,” he added.

Welcoming the FSC’s decision, he said that the percentage of Islamic banking in the country had already reached 20 to 21 per cent, adding that the government aims to completely implement Islamic banking in the next five years.

Ishaq Dar expressed concern that two state institutions — the State Bank of Pakistan and the National Bank of Pakistan — appealed against the Shariat court’s decision. “Now, we have taken those appeals back.”

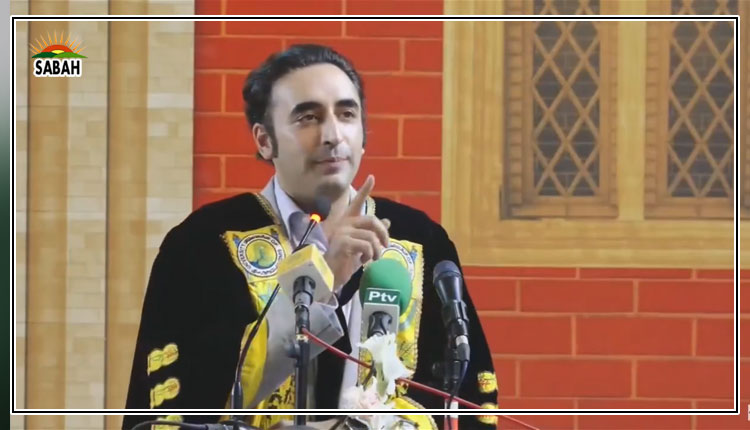

Vowing joint efforts to completely eliminate interest, State Bank of Pakistan (SBP) Governor Jameel Ahmad said the market share of Islamic banking had increased to 21%.

“We have withdrawn the appeal against the decision of the Federal Shariat Court and the SBP is working to implement the decision of FSC,” the SBP governor said. “The central bank has activated a high-level working group in this regard.” He said Pakistanis wanted to get rid of non-Islamic banking system.

Business magnate Arif Habib, the founder of the Arif Habib Group, acknowledged that Islamic banking was expanding rapidly in the country. “Now Pakistanis want to get rid of the interest-based system,” he said and urged the Ulema to guide the citizenry who had become part of the prevailing system.

Renowned religious scholar Mufti Taqi Usmani said that “we all have to raise our voices unanimously to end the scourge of usury”.

Addressing the seminar, the eminent religious scholar said there was no difference in the stance of different schools of thought of Muslims on usury. “Interest-free banking should be implemented, the curse of usury should be eradicated. There is unanimity on this matter.”

Mufti Usmani said it was good that scholars of all schools of thought were participating in the seminar. “Implementation of Shariat is the most important issue, but an armed struggle for its implementation is not permissible.”

He said that the purpose of this seminar was to demand from the government and related institutions that practical efforts be made to eliminate usury.

Earlier, according to Acting President FPCCI Sulaiman Chawla, the business community considers interest as haram but Pakistan pays 40% interest. “Islamic banking facility should be fully implemented in banks, Chawla added.