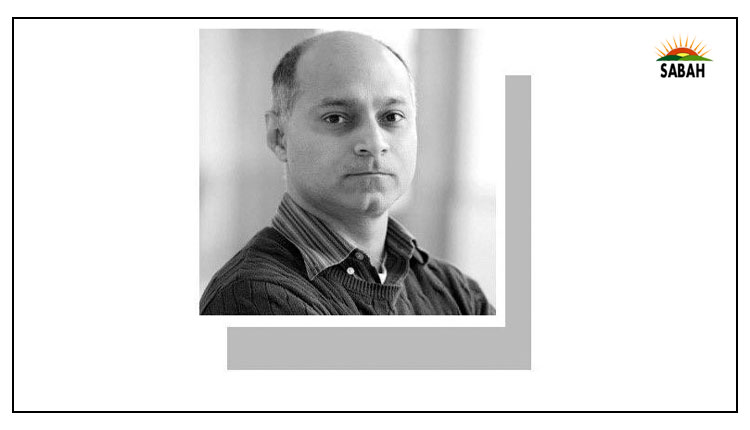

Is the economy improving?…Khurram Husain

IT has now become a routine question. Every TV anchor and people I meet in any gathering all want to know: is it true that the economy is ‘improving’?

The short, and best, answer here is ‘yes and no’. Yes, because the deficits that plagued it have been plugged. No, because growth remains a far-off dream. The proper term to use is ‘the economy is stabilising’, but it is not yet, and will not be for a long time, ready to grow.

This presents a problem. Without growth, you don’t get employment generation to absorb the new entrants to the labour force, of which there are an estimated two million every year. You also don’t get income growth, meaning all the purchasing power that was destroyed in the inflationary fire of 2021 to 2024 will not be recovered. At least not in the near future.

But stability means the end of inflation, the plateauing out of prices which had begun to spiral out of control in early 2021 and reached an inferno by 2023. It means no shrill warnings of default, at least not for a few years, and no catastrophic devaluations, rationing of foreign exchange reserves, import controls, and so on. All that belongs to the past now, mercifully. Pakistan dodged a bullet in the summer of 2022, when foreign exchange reserves ran so low that they brought the country to the very edge of a disorderly and potentially catastrophic default. Then it dodged the same bullet again, in the summer of 2023, when it returned to the same position one more time.

Since July 2023, a set of policies have been implemented steadfastly that have finally averted the dire situation we faced back then. These policies included a very high interest rate and very high tax burden to be borne mostly by those already in the tax net. Between them, these measures extinguished economic growth and choked much of the otherwise routine economic activity. But the net result was that the pesky current account deficit, which returns every few years to drain our foreign exchange reserves, vanished and turned into a surplus. And the fiscal deficit came under manageable control, despite some issues below the surface with provincial surpluses and other line items.

These deficits were the main reason why the country’s foreign exchange reserves had depleted and inflation reached historic highs. With both deficits under control, the reserves stabilised and prices plateaued. So far so good. We’re in a good place.

But we cannot stay here for very long. This stabilisation is what happens every time in the first year of an IMF programme. There are no surprises here. This is precisely what the IMF medicine is supposed to do. Every government that has ever implemented an IMF programme in its first year in power has touted these achievements as its success. This history goes back to 1988, and even earlier. It has happened every single time. A new government enters office. The economy is nearly bankrupt. The new government signs onto an IMF programme. In the first year of the programme the deficits stabilise, growth plummets, reserves rise. The government claims victory.

But the hard-fought stability that comes as a result of the painful decisions made under IMF auspices is only the beginning. The real story is in securing the kind of changes in the structure of the economy that will enable it to grow without depleting its foreign exchange reserves and giving rise to inflationary pressures. The real game is in ensuring growth returns, but either without the deficits that destabilised it, or with the deficits but an accompanying, sustainable way to finance them.

What exactly are these changes? Consider for example, the fact that the state cannot operate a national airline or a power sector without accumulating massive losses. Or consider that the country’s exports remain wedded to the same commodity they were wedded to in the 1980s: cotton. How do we operate state-owned enterprises in a way that doesn’t lead to the accumulation of such massive losses? How do we build an export base beyond cotton?

These are the kinds of questions that require answers urgently to make the transition from stabilisation to growth. But successive governments from 1988 onwards have failed to make this transition. This is the main reason we remain stuck in an endless loop of the same policies that first stabilise the economy, then pump it for growth which destabilises it again making another round of stabilisation necessary.

So if you want to know whether the economy is ‘improving’, ask yourself this question: are deep-rooted changes taking place? Or do you see even the beginnings of deep-rooted changes being brought about? The answer is a clear no. One feeble first step was just attempted in the privatisation of PIA, and we all saw how that ended in an embarrassing fiasco, so much so that various ministers in the government are now blaming each other for the mess.

Until we can see deep-rooted changes being brought about to improve power sector efficiency, a reduction in the rate of accumulation of the circular debt, broadening of the export base as well as the base of revenues, expenditure management, plateauing in the rate of debt accumulation (both domestic and external), rising rate of investment driven by rising domestic savings, and so on, until we can see changes of this sort happening, we cannot say the economy is ‘improving’. We can at best say the economy is ‘stabilising’.

Here is the big problem with stability: it is temporary. Having found a fragile stability, after almost 18 months of hard and intense discipline in the management of the macroeconomic fundamentals, the government now faces the real challenge of transitioning from stability to growth. How well they manage this will decide whether or not we are seeing ‘improvement’.

Courtesy DAWN