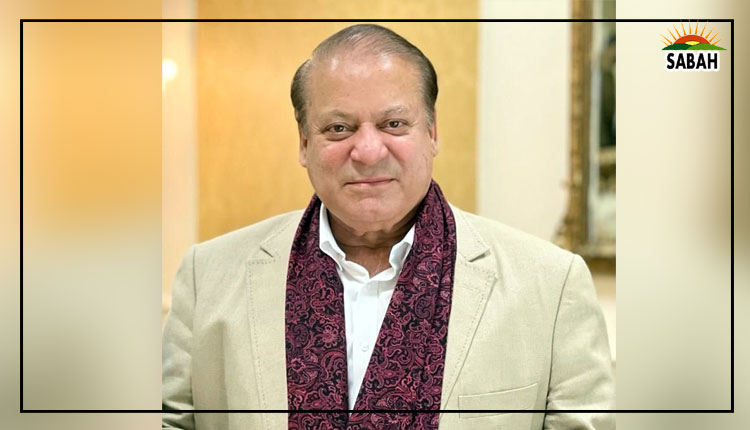

Comparing economic performances…Khurram Husain

PEOPLE often ask which political party has the best track record of managing the economy and producing the best results. It is a tricky question to give a straightforward answer to, but if pressed, the most obvious reply would be none of the above.

The reason is that all major parties have had their stint in power and yet Pakistan continues to be the most reliable client of the IMF, the institution that is the emergency room for economies in distress.

But if one is willing to be a bit patient, there is a more worthwhile answer. First of all, beware of any narratives that roll out a handful of indicators as measures of economic performance.

Be very wary if any party tries to tell you that the GDP growth rate was higher in their time compared to that of others, or that exports hit a higher peak, or revenue collection grew the fastest, or foreign exchange reserves climbed faster and higher in their time than of their rivals, or that inflation was lower during their tenure, or large-scale manufacturing output grew faster than in the time of others or any other such indicator.

There are good reasons to be wary of a performance report card presented in this manner. First, indicators such as these do not capture economic performance in a useful way. They only provide snapshots of what is happening in areas of the economy at one point in time.

The real story always lies in how these indicators are connected to each other, and how they evolve over a period of time. It is as if somebody gave you a handful of indicators, such as good blood pressure, good body mass, a robust appetite as signs of good health. What you dont know, and what these indicators will not tell you, is whether a serious problem is growing inside the body.

Second, and perhaps more importantly, one problem in measuring economic performance is that the results of actions taken today can take a few years to materialise. The best economic stewardship is the kind that produces results over the long term, meaning years after the party that implemented them is no longer in power. This is one reason why the steps needed to wean the country off its chronic dependence on the IMF are not taken by any party. They will not be around to claim the credit.

What the indicators will not tell us, is whether a serious problem is growing inside.

The worst stewardship the economy can be given is the kind that produces short-term positive results but medium- to long-term harm. For example, building projects that are not economically or financially feasible, and do not add to the economys productive capacity, but cost a lot of money, especially in borrowed foreign exchange.

These projects can produce a short-lived spurt in activity that can potentially produce a bump in GDP growth, and give us impressive-looking structures like lavish roads or highways. But they do not help the economys underlying weaknesses, while adding to its debt service bill.

Another example is printing money. If a government resorts to printing money to pay its expenses, it will give a short-lived boost to the economy, but after 18 to 24 months, it will either produce very high inflation, or a rising demand for dollars that the foreign exchange reserves are not able to service, leading eventually to large exchange rate devaluations.

What happens very often in Pakistan is that the government promotes economic growth using tools like the borrowing and printing of money, and points to the resultant growth spurt as evidence of its superior management. But when the inevitable problems appear, they make excuses just long enough for their term to end and power to pass to the next government following elections. Then they blame the next government for the resultant mess, whereas it was they themselves who had created it.

This is what happened in the years leading up to the 2008 election, when the Musharraf regime left behind an inflation bomb and brewing balance-of-payments crisis due to its reckless borrowing and printing policies. And then went on to blame the incoming PPP government for the resultant detonation that happened in November 2008.

It happened again in the run-up to the 2018 election, when the polices of PML-Ns Ishaq Dar, which had produced a short-lived growth spurt but birthed massive balance-of-payments deficits, left behind a crisis-like situation for the incoming PTI government.

Then they went ahead and blamed the PTI for creating the mess and destroying the growth they had generated. It happened one more time when the PTI government was ousted in a vote of no-confidence in April 2022, leaving behind an inflation bomb and a balance-of-payments crisis for the incoming PDM government to manage, and then blaming them for it.

In each case, the policies that produced the growth that respective parties bragged about as their achievement, also produced the ensuing crisis. But the growth came during the time the party was in power, while the crisis was left for the next government to tackle, thereby making it easy to take the credit for the growth and blame the crisis on the successor. Fact is, both the growth and the ensuing crisis were two sides of the same coin, and could not be looked at in isolation.

This is why it is important to be wary of the report cards that parties present when giving their economic performance stories. In all cases, the growth presented has contained the seeds of its own ending.

It is a story of throttling and choking the economy, in quick succession, in their aim to claim the growth as their own and blame the disaster on the other. It is important to reject these performance stories as elections approach, and a new government prepares to take the reins of the economy.

Courtesy Dawn