A tsunami of loans … Hassan Baig

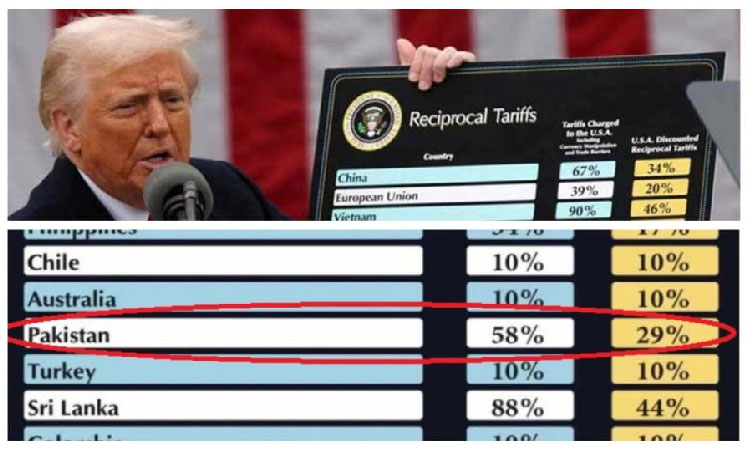

Pakistan is under a severe debt trap, suffering from economic stagnation, economic slack and high inflation. There seems to be no solution to the countrys economic woes as the IMFs Extended Fund Facility (EFF) could not provide relief to the poor.

Pakistan is getting loans to pay back the existing loans, which is the worst strategy adopted by any country. The ever-increasing loan portfolio has added more burden on the economy, resulting in economic slowdown and negative growth. All macro-economic indicators are in a bad shape with no hope of economic recovery in the near future.

The outgoing fiscal year saw the total huge loan reach Rs58.962 trillion, an increase of over Rs11 trillion or around Rs33 billion daily. The external debt increased to Rs21.908 trillion mainly owing to the depreciation and devaluation of the rupee against the dollar. We have to pay back about Rs7.302 trillion in debt servicing out of the total budget outlay of Rs14.5 trillion during the current financial year. There seems to be no strategy to manage this loan burden on the government exchequer.

The skyrocketing circular debt is another headache disturbing all economic plans. The accumulated impact of circular debt is about Rs4.0 trillion. The IMFs standby agreement has already talked about circular debt management, while emphasizing the need for opening up imports, discouraging subsidies and openly spelling out conditions for no amnesty scheme in the future to manage the economy.

The average increase in circular debt is about Rs52.5 billion on a monthly basis, which is disturbing the countrys economic and financial management plans. Inflation is a by-product of regular price hikes owing to multiple reasons including but not limited to circular debt resulting in an increase in electricity prices.

The IMF while extending the $3 billion standby agreement has outlined Pakistans economic challenges, which are complex in nature and need a major overhaul. The IMF has outlined a set of stipulated conditions in its country report, prohibiting currency manipulation not to let the premium between the interbank and open market on an exchange rate go above 1.25 per cent. It also says that Pakistan will not use forex sales to prevent rupee depreciation.

The IMF has further asked the government not to extend amnesty schemes or provide subsidies for SOEs. It encourages Pakistan to focus on improving its governance structure. It has also suggested to hike interest rates to reduce or control inflation as a monetary policy tool and tax the agriculture and construction sectors.

Almost all sectors of the economy are suffering owing to the countrys unmanageable debt, which has also prevented it from meeting its SDG targets; before that, Pakistan could not meet its Millennium Development Goals due to poor economic performance. Poverty is on the rise due to the ever-increasing cost of living at a time when the rate of unemployment is increasing.

Pakistans shrinking job market is a result of multiple factors, including low output posted by the large-scale manufacturing sector. Other areas like education, health services, agriculture, manufacturing, imports, exports, and remittances have also performed unsatisfactorily. The perennial volatile exchange rate due to falling foreign exchange reserves is another headache for the government which has to take strict measures to stabilize the currency which has now touched around Rs285 per dollar.

The situation has taken a turn for the worse, and profiteers have found this to be a perfect opportunity to profit off of peoples vulnerabilities. Many unregistered online apps and lenders are on the rise with the sole purpose of looting the poor and exploiting their conditions to make money. A few weeks ago, a debtor who fell in the trap of these loan sharks died by suicide as he was not in the position to pay back the loan which grew exponentially with compound interest.

The FIA, SECP and PTA are now trying to nab such lenders to protect borrowers from predatory online lenders, but the exercise would go in waste as the rising poverty has no end in sight. This suicide case shows the poor economic conditions owing to the rising prices of petroleum products, utilities and food.

The business sector is the worst hit by the current economic slowdown, and rising prices have increased the cost of doing business. The situation can best be analyzed through the private capital outflow from Pakistan. It is quite unfortunate to see a few multinational brands closing down their businesses in Pakistan due to uncertain future prospects.

The same is the case of the temporary shutdown of auto motor companies due to restrictions placed on the imports of their spare parts urgently needed for their manufacturing units.

The lack of funds and financial resources has also resulted in the partial collapse of the healthcare system in Pakistan as we have failed to improve health infrastructure to tackle our huge population. Government hospitals lack sufficient doctors, nurses and other staff to manage seriously ill patients. The federal government allocated only Rs24.21 billion (overall 2.95 per cent of the GDP including provincial spending) for the current financial year for the healthcare sector, which is insufficient by all means. Pakistan ranks 122nd out of 190 countries in the World Health Organization (WHO) performance report.

The education sector is equally suffering from a lack of funds and financial resources, and almost 25 million children are out of school which is worrisome for all of us. The Higher Education Commission (HEC) has been allocated about Rs59 billion under the Public Sector Development Programme (PSDP). It is unfortunate that Pakistan is spending only 2.4 per cent of the GDP on its education sector. Our literacy rate is 60 per cent, and this unfortunate situation is a reason why Pakistani people find it difficult to get some space in the international community.

The social protection programme is in shambles although the BISP is working well to take care of the poor segment of society. But such programmes also suffer due to a lack of financial resources and rupee depreciation. The IMFs condition to keep the floating market based exchange rate is another plight for economic managers.

Hiking interest rates to reduce inflation is another challenge as our inflation is cost-push, which cannot be cured by increasing the policy rate by the State Bank of Pakistan (SBP). The vulnerability of the poor segment of society is increasing due to the factors stated in these lines.

There is an immediate need to address the issue of the debt-trap tsunami that is playing havoc with the economy. The poor suffer the most. Debt restructuring and re-profiling has become all the more important. There is an urgent need to chalk out an elaborate long-term plan for debt retirement to help improve economic growth. This will allow the country to take care of its social protection programmes, health, education, defence needs and, most importantly, to get rid of the menace of living on borrowed money.

The writer is a formeradditional secretary and can be reached at:

hassanbaig2009@gmail.com

Courtesy The News