Untamed economy…By Farhan Bokhari

The State Bank of Pakistan’s latest interest rate cut, on Monday, by another two per cent to 13 per cent in response to demands from segments of the business community failed to set the pace for a broader recovery.

The latest cut has been driven by the oft-repeated official claim of a consistent drop in inflation that now stands at single digits. Hence, the argument for a cut in interest rates to narrow the gap between Pakistan and its South Asian peers. The cut which followed a consistent drop in interest rates since June this year, was meant to spur investment activities flowing from more affordable borrowing rates.

Yet, the State Bank has overlooked considerable challenges surrounding Pakistan’s economy. In chasing the latest reported inflation figure, the bank appears to have disregarded a chronically low rate of savings in Pakistan. At 13 per cent of Pakistan’s GDP, the country’s savings-to-GDP ratio trails behind that of over 25 per cent in Bangladesh and just over 29 per cent in India, Pakistan’s two regional peers.

Though sections of the business community sought twice as high a cut as Monday’s drop, they have clear incentives to demand lower interest rates as that would translate in to lower costs of capital borrowed from banks. Yet, the interests of segments of the business community stand in sharp contrast to Pakistan’s chronic failure to raise its interest rates, an essential prerequisite for raising domestic savings.

Though the lowering of inflation to single digits has been celebrated by Pakistan’s government leaders, the trend easily masks a disregard for the larger picture. In the two years preceding the last financial year which began in July this year, Pakistanis battled inflation well in the double digits. For many households across the country, the damage from living in that era has already been done.

For the moment, the way forward appears to show little consideration for tackling the large element of Pakistan’s impoverished households which represent more than one-third of the population. That translates into a staggering figure of at least 80 million Pakistanis living below the poverty line – a proportion that makes their lives in squalor nothing less than lives in abject poverty. This is clearly a ticking time bomb whose risk for the future is far from appreciated by the ruling structure.

The prime minister and the chief minister of Punjab have together announced plans to oversee an expansion of Pakistan’s infrastructure that fails to answer challenging questions over human security.

Across Pakistan, the failure of the last wheat crop has deeply complicated the matter of lifting the country from the prevailing food insecurity. In the 1990s, the Islamabad-Lahore M-2 motorway was launched amidst claims that the project was set to bring a new wave of investments. Though other motorways have joined the M-2 during the past three decades, the low industrial growth across Pakistan has thrown up a puzzling question – exactly what will it take for Pakistan to emerge from a low growth, low savings and low investments country to an era of robustness on all three fronts. Filling the gap requires consistent policies and settled politics too.

Going forward, Pakistan needs to focus on three equally significant fronts.

First, the State Bank of Pakistan must pause a further interest rate cut and consider in-depth the country’s future outlook. In the short term, succumbing to pressure from segments of the business community or the ruling structure must be considered in tandem with the terrible failure to significantly lift savings in Pakistan – a cause that must stand centrally at the heart of the country’s future uplift. In the process, tamed inflation alone can not be the sole consideration for the future direction of interest rates.

Second, Pakistan’s continuing failure to lift its economic prospects is driven by multiple failures. Matters like a narrow base of income taxpayers in Pakistan at less than two per cent of the population cannot be ignored. Failure in this area has periodically prompted measures like the recent push to slap Pakistani banks with a raised advance-to-deposit ratio or ADR – a measure of the proportion of their total deposits given as loans. A failure to comply will be followed by a penalty on banks – a visibly unfair step.

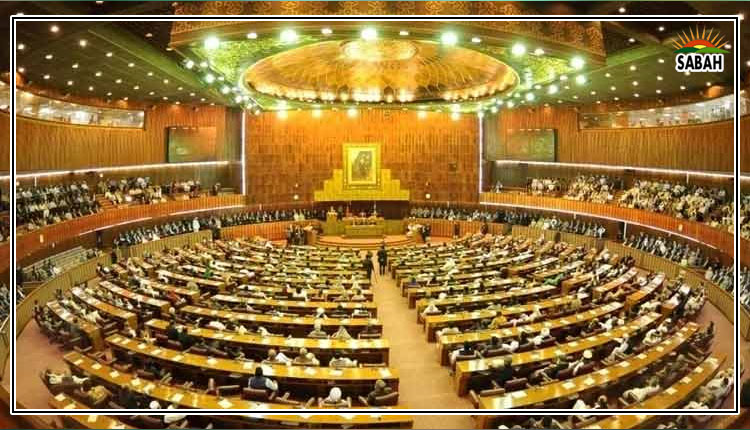

Finally, the focus of development needs to be squarely shifted from Pakistan’s infrastructure to the needs of its human beings. Practices such as arming members of parliament and provincial legislatures with massive financial resources at their disposal in the name of development must be immediately suspended. Pakistan needs to save every penny that it can muster to be centralised and spent on new dams, agricultural support and revamping of existing infrastructure.

Short of a fundamental shift in priorities, even an era of tamed inflation and lower interest rates will fail to stabilise Pakistan where it matters the most.

COURTESY