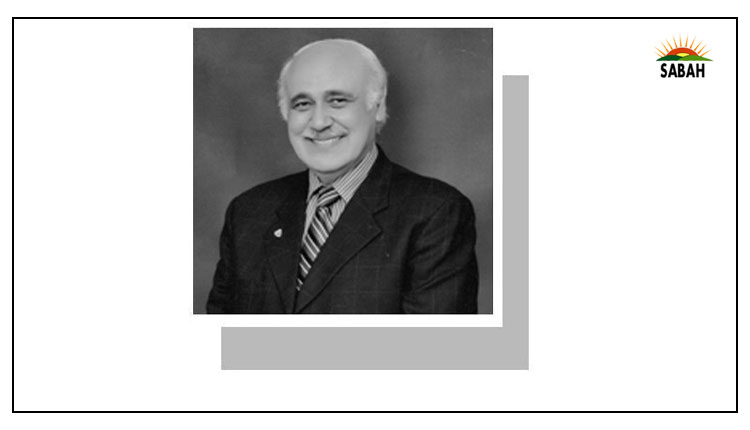

Hope triumphant … F.S. Aijazuddin

SOMEONE in the IMF is not familiar with Dr Samuel Johnson’s witty definition of a second marriage: “a triumph of hope over experience”. The IMF and Pakistan have been in and out of wedlock not twice, but multiple times.

One would have imagined that an institution as experienced as the IMF would spot a habitual offender amongst a pack of its financial delinquents. Apparently not. No sooner had Pakistan digested the Stand-By Arrangement (SBA) of $3 billion extended by the IMF in 2023-24, than it applied for a new loan of $7bn. Even addicts draw a breath before the next snort.

Recall our predicament in 2023, as we waited desperately for the release of the last $1.1bn tranche of the SBA. Prime Minister Shehbaz Sharif assured the IMF MD Mme Georgieva that, if re-elected, he stood “committed to turning over the economy with the help of IMF and development partners”.

On her part, Mme Georgieva reminded him that, although he had “built a very convincing case”, the IMF Board recalled “the past trust deficit” and reiterated its scepticism about Pakistan’s freshest undertakings. She then mollified her Board with the assurance that Pakistan would “deliver on its commitments … as she had personally met the prime minister and seen his seriousness to deliver”.

In reciprocation, our PM expressed his “profound gratitude” for her “support and assistance” and sent her some mangoes in appreciation of “her leadership and professionalism”. Apparently, mangoes did the trick. A year later, on Sept 25, 2024, the IMF approved a 37-month Extended Arrangement for SDR 5,320 million. (around $7bn). It was an anniversary of sorts. This is the 25th time Pakistan has approached the IMF for a bailout.

To obtain this $7bn loan and its first tranche of $1.1bn., Pakistan assured the IMF that it will implement radical changes which will test the public’s patriotism and the sinews of our federation. The new programme comes with several conditions, or ‘bitter pills’. These include bringing undertaxed sectors including retail, export, industrialists, developers, and large-scale agriculture into the income tax regime.

The Government has agreed to reduce “non-transparent support through exemptions for privileged sectors like real estate, agriculture, manufacturing, and energy, as well as, through the proliferation of Special Economic Zones”. The IMF demands the abolition of SEZs by 2035. CPEC, however, plans into 2030 the expansion of SEZs and Free Trade Zones, especially Gwadar Port.

The IMF programme repeats a familiar mantra — earn more, spend less, and minimise borrowing. The IMF recognises the inherent schisms in Pakistan’s political structure: “Political economy considerations and pressures from vested interests could delay or weaken the reform momentum and put at risk still-brittle stability.”

The IMF also expects Pakistan to be supported by “development and bilateral partners”, ie, the World Bank, ADB, Saudi Arabia, the UAE, and China. The CPEC is the IMF’s bugbear. The IMF sought transparent disclosure; Pakistan hid behind legal obfuscation. In 2022, the IMF carped that Pakistan owed more to China than the IMF and DFIs combined. In 2022, Pakistan owed China $26.6bn, and the IMF about $7bn.

The IMF’s staff report supporting the $7bn loan approval contains an odd justification: “Reputational risks would arise if the Fund were perceived as treating Pakistan differently from other members that ostensibly enjoy less support. Alternatively, not proceeding with a new programme also raises reputational risks as the new authorities, or other members, may accuse the Fund of not being evenhanded.”

The IMF recognises that some debtors have no prospect of being repaid on time, unless a major creditor (China) either reschedules or rolls over or writes off its loans. The Chinese may do the first, possibly also the second. China is not in the business of giving charity without cause.

When will China tire of being Pakistan’s banker of the first and the last resort? One suspects it will reconsider its largesse after the next US administration is in place.

For the time being, Pakistan is enjoying the advantage of a pre-US election windfall. The latest IMF loan is spread over the next three years, with periodic reviews. Whichever candidate — Donald Trump or Kamala Harris — wins the White House in November, our $7bn IMF lifeline will definitely come under scrutiny.

President Trump gave a previous prime minister a personal tour of the White House. Will he be inclined to extend a similar courtesy to his successor? Kamala Harris knows Pakistan as India’s irascible neighbour. Her DNA could colour her judgment.

Meanwhile, to paraphrase Herbert Hoover: accursed are the young, for they shall inherit our national debt.

Courtesy DAWN