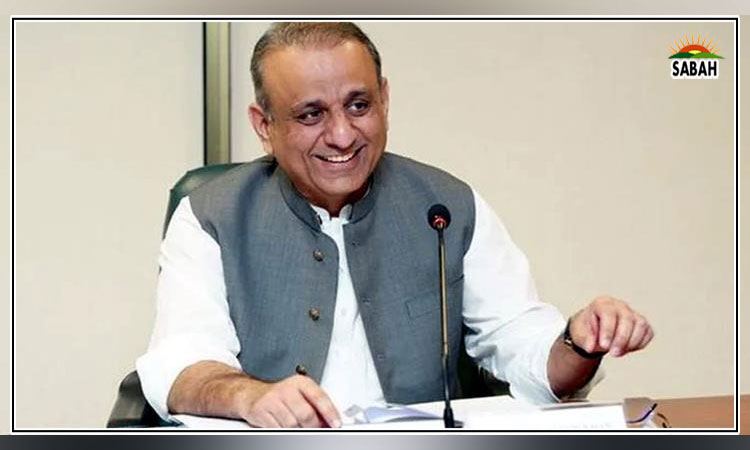

Finance Minister Muhammad Aurangzeb unveils federal budget 2024-25 with a total outlay of Rs 18877 biln

ISLAMABAD, June 12 (SABAH):The federal budget 2024-25 with a total outlay of 18877 billion rupees has been announced with focus on fiscal consolidation and relief measures for the common man.

Presenting the budgetary proposals in the National Assembly on Wednesday, Minister for Finance and Revenue Senator Muhammad Aurangzeb said the gross revenue receipts have been estimated at 17815 billion rupees. These include FBR’s revenue collection of 12970 billion rupees and non-tax revenue 4845 billion rupees. The share of provinces in the federal receipts will be 7438 billion rupees.

The Finance Minister said the growth rate is expected to be 3.6 percent during the next fiscal year. Inflation is expected to be 12 percent, budget deficit 6.9 percent of GDP and primary surplus will be one percent of GDP. He said that 9775 billion rupees will be paid for interest payment.

Muhammad Aurangzeb said 1400 billion rupees have been earmarked for the PSDP. An additional one hundred billion rupees have been allocated through public-private partnership. He said the development budget will be at the historic level of 1500 billion rupees. He added that 2122 billion rupees will be provided for defence requirement.

The Finance Minister said that 839 billion rupees have been reserved for the expenditure of civil administration, while 1,014 billion rupees have been set aside for pension expenditure and 1,363 billion rupees have allocated as subsidy on electricity, gas and other sectors.

Muhammad Aurangzeb said grants worth 1,777 billion rupees have been earmarked for Benazir Income Support Programme, AJK, Gilgit-Baltistan, merged districts, Higher Education Commission, Pakistan Railways and IT sector.

The Finance Minister said the major volume of development budget manifests the government’s resolve to develop infrastructure, transportation, energy and IT sectors as well as address the challenges in the management of water resources.

Muhammad Aurangzeb said that completion of ongoing projects will be given priority in the PSDP 2024-25. He pointed out that eighty-one percent resources have been allocated for the ongoing projects and nineteen percent for the new projects.

He said development of basic infrastructure is the basic responsibility of the government and for this purpose it has been proposed to allocate fifty-nine percent of the amount.

For the social sector, it is proposed to spend twenty percent of the development budget.

The Finance Minister said ensuring balanced regional development is a constitutional responsibility. Hence, ten percent resources have been earmarked for AJK, Gilgit-Baltistan and the Tribal districts about eleven point two percent resources have been set aside for other sectors such as IT and telecom, Science and Technology, Governance and production.

Announcing three pronged strategy to reduce pension bill, Muhammad Aurangzeb said reforms will be introduced in the existing pension scheme as per international best practices that would considerably decrease pension liability for the next three decades.

He said contributory pension scheme has been introduced for new employees which will be supported by monthly government contribution to ensure fully funded pension for future employees since the very beginning of their service.

He said a pension fund will be established to manage pension liability.

Regarding agriculture sector, the Finance Minister announced that five billion rupees have been proposed for the Markup and Risk Sharing Scheme for Farm Mechanization under the Kissan Package announced by Prime Minister Shehbaz Sharif in 2022.

He said under the scheme, financing will be available to procure planters, tractors, thrashers, harvesters, and mobile grain dryers.

The Finance Minister said 206 billion rupees have been earmarked for water resources in which 45 billion rupees have been set aside for Mohmand dam, 40 billion for Diamer Bhasha dam, 18 billion rupees for Chashma Right Bank Canal and 10 billion rupees for Pat Feeder Canal.

Unveiling the allocations for the energy sector, the Finance Minister said 253 billion rupees have been set aside in this regard.

For IT sector, he said 79 billion rupees have been earmarked under which seven billion rupees will be for digitalization and reforms in the FBR. This amount will help expand tax base and address loopholes by using state of the art IT system.

An IT park will be established in Karachi at a cost of 8 billion rupees while 11 billion rupees will be set aside for Technology Park Development Project in Islamabad.

Highlighting the importance of remittances sent by overseas Pakistanis to their families, the Finance Minister said over 86.9 billion rupees have been proposed in the budget to facilitate the Pakistani diaspora. This amount will be spent on re-imbursement of TT charges.

He said immigration landscape will be digitized to simplify the immigration procedure for facilitation of overseas Pakistanis.

Muhammad Aurangzeb said Mohsin-e-Pakistan award is being introduced for overseas Pakistanis to recognize their extraordinary services for the country.

Highlighting the importance of human development, Muhammad Aurangzeb said a substantial amount has been proposed to improve infrastructure and educational facilities in 167 government schools in the federal capital.

He said government is going to introduce a school meal program for physical and mental nourishment of students under which balanced and nutritious food will be provided to students of 200 primary schools of Islamabad.

He said pink buses will be plied from rural to urban areas for female students. Besides, Danish schools are being expanded to Islamabad, Balochistan, Azad Kashmir and Gilgit-Baltistan as per directions of the Prime Minister.

The Minister said the government is implementing the principles of equality and justice in tax laws. He said the exemptions and concessions in taxes not only lessens government’s revenue, but also affect socio- economic development.

The Minister said after reviewing the concessions and exemptions in the Sales Tax, the government has proposed waiving off certain concessions and exemptions. He said some of the goods would be taxed on reduced rate while other would be taxed on standard rate.

The government has also proposed to increase GST rate on Tier-1 Retailers of textile and leather products from fifteen to eighteen percent.

It has also been proposed to impose standard rate of eighteen percent tax on Mobile Phones.

It has also been suggested in the budget to impose withholding tax on scrape of copper, coal, paper and plastic, while exemption from sales tax on iron and steel scrap has also been proposed in the budget to discourage tendency of fake or flying invoices.

The Minister said that exemption in taxes for five years was given to newly merged districts, erstwhile FATA and PATA, in 2018. This exemption was ended in 2023, which was later extended for one more year. However, now this exemption is being withdrawn gradually to bring these areas into national mainstream.

Similarly, the exemption in income tax given to residents of erstwhile FATA and PATA has been extended for one more year.

The Minister said a fixed tax of 12 percent annually is currently enforced on unpaid sales taxes and FED, which is being increased by KIBOR+3 percent in order to harmonize it according to policy rate of the State Bank of Pakistan.

The Finance Minister said the government is undertaking several steps to give impetus to climate mitigation efforts. For this purpose, he said that Pakistan Climate Change Authority will be made functional.

He said that national Climate Finance strategy will be prepared by October this year with the aim to bring global climate finance to Pakistan which will help implement projects to reduce carbon emission.

He said that National Digital Climate Finance Monitoring dashboard will be established to maintain data of the foreign assistance.

He said that Gender and climate budget tagging has been done in the budgeting and accounting of the government.

Muhammad Aurangzeb said the government is allocating four billion rupees for E-bikes and two billion rupees for energy efficient fans.

Unveiling relief measures, the Finance Minister announced 25 percent increase in the salaries of government employees from Grade-1 to 16 and 20 percent from Grade-17 to 22.

He also proposed 15 percent raise in the pension of retired government employees.

The minimum wages are being increased from 32,000 to 37,000 rupees.

The Minister said taxes on vehicles’ registration and purchase up to 2000 CC were taken on the basis of engine capacity. However, it has been proposed in the budget that tax on all the vehicles would be taken on prices of vehicles instead of its engine capacity as it was enforced earlier.

Prime Minister Mian Muhammad Shehbaz Sharif, Deputy Prime Minister and Foreign Minister Senator Mohammad Ishaq Dar and other leaders of the parliamentary parties attended the session. The session was chaired by National Assembly Speaker Sardar Ayaz Sadiq.