Inflation vs growth: misplaced priorities ۔۔۔۔Dr Miftah Ismail

Although the inflation number for May has come down to 11 per cent from over 30 per cent in May last year, inflation for this fiscal year is still 24 per cent.

Our economic growth rate is an anaemic 2.2 per cent, which is less than our population growth rate of 2.55 per cent. Last year, our economic growth rate was close to zero. Thus over the last two years Pakistanis have become poorer by almost 3.0 per cent. And, given the lopsided effects of inflation, poor Pakistanis have become poorer by an even higher percentage. That is why, according to a World Bank calculation, 90 million Pakistanis are below the poverty line and another 10 million are expected to go below the line this year.

The two main interrelated reasons we have had such back-breaking inflation over the last two years are excessive printing of currency notes by our State Bank and rapid devaluation. The State Bank has had to print notes to finance the large and increasing federal deficits we have incurred since the last NFC Award in 2010.

Our currency has devalued rapidly because of the large foreign exchange loans our government has to repay – loans we took not just to finance the trade deficit or difference between our larger imports and smaller exports, but also because we borrowed over the years substantial sums in foreign exchange for many megaprojects that have not resulted in any foreign exchange earnings. Now that these loans are coming due and we can’t find newer and newer sources to finance our government’s bad habits and policy mistakes, our currency is losing its value.

Unfortunately, inflation was also turbocharged by the inordinate increases in power and gas prices. We now have the highest prices of gas and power for most categories of customers in South Asia.

Worse still, Pakistanis are now paying the highest proportion of their incomes in utility bills compared to any other nation in Asia. And yet, such are the inefficiencies, theft and policy mistakes in the sector that, after trying for more than two decades under several different governments, we are not even close to ending the power sector and gas sector financial deficits that translate into circular debt or require government subsidies.

One reason we have been able to reduce inflation is due to the extremely high interest rates that have stifled economic growth and suppressed investments. Because of our very rapid population growth, more than two million young people enter the labour market annually. But with hardly any growth in the economy, overall employment hasn’t grown and hence more people haven’t been absorbed in the labour force. Thus high interest rates, set to bring down inflation, have resulted in a substantial increase in unemployment and poverty.

All economic choices have costs and benefits. To obtain the benefits of relatively reduced inflation, we imposed heavy costs on businesses and the unemployed. However, the federal or provincial governments didn’t really share in this sacrifice. Their expenditures continued to grow unabated and we continued to produce high deficits.

The entire cost of bringing inflation down from its peak last year has been borne by the private sector and the taxpayers. Moreover, even as the May 2024 number is good, inflation is still in double digits and of course one month does not a trend make.

When inflation is still high, per capita growth is negative, poverty is increasing, fiscal deficits are unsustainably high, tax revenues as a percentage of GDP remain quite low, and both external debt and local debt are dangerously high – what is our government doing? Almost exactly what it should not be doing.

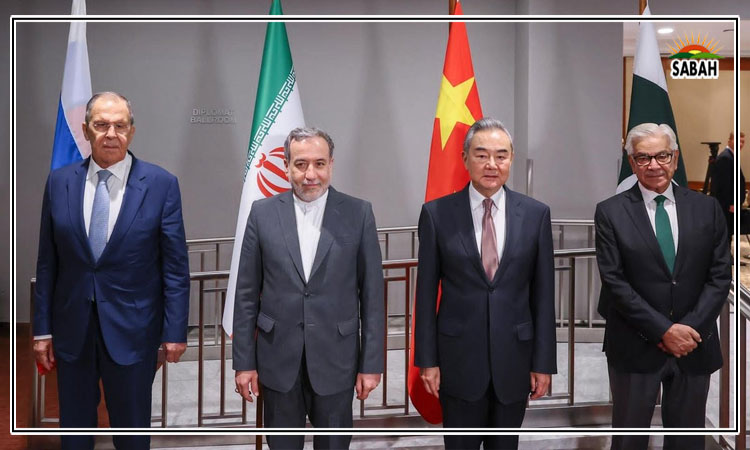

The prime minister and some cabinet members are in China meeting the Chinese leadership. An issue that might come up is that we still need to pay the Chinese power producers Rs470 billion (or about $1.68 billion) of their past dues. Moreover, the IMF and World Bank want us to negotiate with China to reschedule the payments due to Chinese power companies over the next five years and pay them during the next ten years or so.

But even as we have delayed their past payments due to the financial crunch, the government is also seeking fresh new project loans for a new railway line from Karachi to Peshawar for $6.8 billion (or Rs1900 billion) and a highway from Thakot to Raikot for about $2 billion (or Rs560 billion).

So even as we have difficulty paying China’s past dues, and are trying to reschedule trillions due to them over the next five years, and there are still many other loan-financed projects under construction, we are seeking new project loans for Rs2460 billion for these two projects. (There are other projects, such as a power plant for Gwadar, that I am not discussing here).

Is this really the time for borrowing more foreign exchange for projects that are neither economically feasible nor will generate the foreign exchange required to service and repay these loans? Is this the right priority?

Then there are reports that our government is trying to come up with some ‘relief’ for the people in the budget. It sounds like a good initiative, but two things must be considered. One, the government’s ‘relief’ to the people is paid for by borrowing more, which causes more inflation. Thus poor and working class people end up bearing the cost of the relief. Second, more often than not, the ‘relief’ is given to the politically powerful not the economically weak.

Rumours are also rife that rather than expanding the tax net to include large agricultural landlords or rich urban property owners, tax collection efforts this year will again focus on the manufacturing industry and salaried employees.

Although I earnestly hope that the government will not increase taxes on salaried people, I hear it government is looking to raise another Rs500 billion to Rs600 billion by taking away exemptions from personal income taxes – this includes business individuals too. This is why I firmly believe that unless the federal government is allowed to tax agriculture and property, we will continue to squeeze the salaried and middle classes to the point of crushing them.

The federal and provincial governments’ insatiable appetite to spend, coupled with the IMF demand that we limit our deficit to less than our total debt servicing, means that the federal government is now considering imposing 18 per cent sales tax on medicines, milk powder and other necessities.

I wish the government had used the last three months, after its stunning victory on February 9, to work with the provinces to broaden the tax base, reduce federal and provincial expenditures and adjust the NFC Award. But it seems the government will continue to tax the already taxed and continue to coddle the powerful. Another year wasted.

If Pakistan is to ever get out of the fiscal mess we have placed ourselves into, we will have to rethink how we finance our federal and provincial budgets and bring about horizontal and vertical equity in our tax regime. But as long as we tax only the salaried and the middle classes, and manufacturing and corporates, and protect the politically powerful, we will keep staring at the financial abyss.

The writer is a politician and an economist. He tweets/posts @MiftahIsmail

Courtesy The News