Elections and elitism …. Hussain H Zaidi

As the nation gears up for national elections, the question that dominates media and political discourse is: which party will carry the day? Will it be the current favourites – the PML-N? Or will the PTI, which is currently under a cloud, have the last laugh? Or will master politician Asif Zardari pull a rabbit out of the hat?

While this question is important, particularly for the political parties, their supporters, movers and shakers (both actual and self-styled) and bookmakers, it boils down to answering which among the elite will rule 240 million plus people.

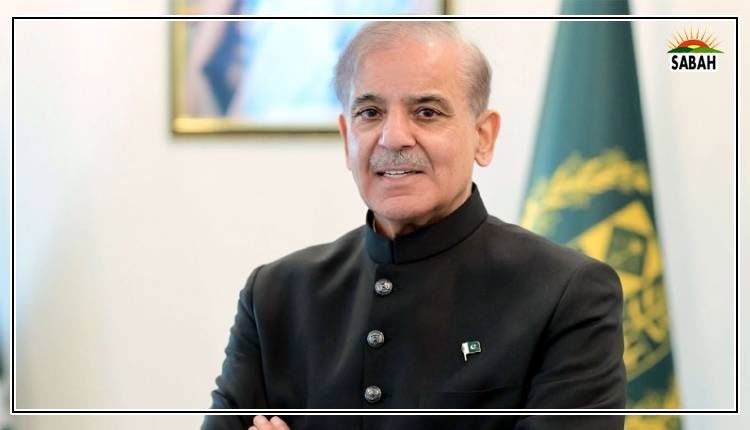

PDM leaders Shehbaz Sharif (centre), Asif Ali Zardari (right) and Fazlur Rehman (left) speak during a press conference in Islamabad, on March 28, 2022. — AFP

PDM leaders Shehbaz Sharif (centre), Asif Ali Zardari (right) and Fazlur Rehman (left) speak during a press conference in Islamabad, on March 28, 2022. — AFP

A more fundamental question for the people at large is whether the forthcoming elections usher in an improved lot for them. The fact that the country has remained in the grip of hyperinflation over the past two years, which has put both low- and middle-income households in a spot, will make the state of the economy a major contributor to the electoral outcome.

That said, the economic question is much wider – the price spiral being only part of it – and pertains to moving towards a more egalitarian, or let’s dispense with euphemism, a less elitist society. As a rule, the leading political parties in Pakistan have their heads in the cloud when facing the problem of egalitarianism or elitism. Yes, in manifestos and speeches, they do virulently attack elitism. Yet, while in the saddle, they do little to attenuate it, as their economic policies aim at making the affluent better off through tax relief and subsidies.

Since democracy is a people-centred political system, one would expect that in a democracy elitism would be conspicuous by its absence. However, in both theory and practice, democracy and elitism are not mutually exclusive. The elite theory popularized by Italian social scientists Pareto and Mosca argues that all societies, regardless of the form of government, are governed by one or more political elites.

Pakistan has often been described as an elitist state. The essential narrative is that the national economy was captured by a small elite, which both manipulated the market and controlled the state. The result was a vicious combination of inefficient resource allocation (market failure) and inequitable income distribution (government failure). The elite has been so powerful that a change in government, or even a transition from despotism to democracy and vice versa, failed to hold it in check.

Instead, successive governments strengthened, as well as in return benefited, from elite capture. Their policies on the one hand promoted cronyism and rent seeking and on the other neglected social sector and human resource development so that the elite’s preeminent position remained unchallenged. The already scarce resources were allocated primarily to grand infrastructure-related projects in the name of development. Such projects served as a source of rent for the businesses and commissions and kickbacks for the people in power.

The PTI has been a strong exponent of this narrative. However, during its four years in power, its support for the elite wasn’t any less. The bottles might have changed but the wine was the same.

Even if successive governments didn’t by design promote elitism, it can’t be denied that for one reason or another, social welfare has taken a backseat in public policies. Besides, welfare policies have had a very narrow focus – viz income transfer to the people at the bottom of the economic heap. A case in point is the Benazir Income Support Programme. While cash transfers may help the recipients survive another day, they are an extremely weak instrument for promoting public welfare or even poverty alleviation.

The ultimate test of a poverty alleviation programme is that the number of its beneficiaries shrinks over the years and the programme eventually phases out. Cash transfers serve elitism in that they perpetuate the culture of dependence on the elite, as the recipients by and large have neither the incentive nor the opportunity to become socially useful economic agents. Though in normal circumstances cash transfers make little economic sense, these are an important means of garnering political support and winning elections.

Human resource development (HRD) is an important means of increasing public welfare in the long run. This is especially true of a labour-abundant country like Pakistan, which will always find it tough to realize its growth potential without adequate HRD. However, HRD has remained a neglected area in Pakistan.

Not surprisingly, Pakistan is presently ranked 161 among 191 nations on the UNDP’s Human Development Index (HDI), which comprises three broad indicators: life expectancy at birth, expected and mean years of schooling, and per capita national income. The country is placed under the ‘Low Human Development’ category, the lowest category. Although between 1990 and 2021, Pakistan’s HDI value has gone up from 0.400 to 0.544, it is still well behind the average score for the world (0.732), developing countries (0.685) and South Asia (0.632).

The HDI doesn’t directly take into account income distribution. However, countries’ HDI performance is adjusted for inequality in income distribution and other relevant indicators. Pakistan’s current inequality-adjusted HDI value is 0.380 compared with the world average of 0.590, developing countries’ average of 0.538, and the South Asian average of 0.476.

Pakistan’s coefficient of human inequality is 29.2 compared with the world average of 19.4, developing countries’ average of 21.4, and South Asian nations’ average of 24.3. The coefficient is measured on a scale of 0-100. Zero means perfect equality, while 100 means perfect inequality.

There are two major impediments to upending elitism. The first is to put in place a supportive public policy framework, which targets egalitarian economic growth. Several politico-economic factors discourage framing such a policy: The government may lose a considerable part of its political capital, as the lobbies which helped a party come into power through hefty financial contributions and now want their share of the pie may resist such a move. There is also, in the short run at least, often a trade-off between economic growth and equality. Egalitarian considerations may put the brakes on growth. For instance, stringent application of labour laws may shore up the cost of production and thus discourage private sector investment. Since governments usually have their eyes on the next elections, they prefer short-term gains. Keeping wages deliberately low is not a sound recipe for long-term development.

The antithesis of elitism is welfare economics or social democracy, whose most concrete embodiment is the welfare state. A major challenge in establishing a welfare state is the availability of finances. A welfare state requires an expansionary fiscal policy, which can be financed either through taxes or through deficit financing – though the latter isn’t sustainable in the long run. Therefore, a large and steady stream of public revenue is essential for pursuing welfare policies.

In Scandinavian countries – Denmark, Norway, Sweden, and Finland – where social democracy proved a great success in the latter half of the 20th century, the tax-to-GDP ratio has been as high as 40 per cent on average, which allowed sustained fiscal expansion. Besides, in those countries, there was nationwide support for a welfare state, not as a matter of rhetoric but as a matter of contributing to its cause. For instance, wages and other working conditions were determined by a tripartite arrangement of employers, workers and the government.

By contrast, in Pakistan, the tax-to-GDP ratio has been as low as 10 per cent. Pakistanis by and large are averse to paying income or wealth taxes – though they may contribute generously to charity. Traders (retailers and wholesalers) account for 18 per cent of GDP but contribute less than one per cent to the national kitty in taxes. Being well-organized and having strong political connections, they defy attempts to tax them. The same goes for the agriculture sector.

In such circumstances, a welfare state can only be set up – granted there’s the political will to do so – by racking up public borrowing and thus accumulating fiscal deficit, which is not a long-run viable option.

The writer is an Islamabad-based columnist. He tweets/posts @hussainhzaidi and can be reached at: hussainhzaidi@gmail.com

Courtesy The News