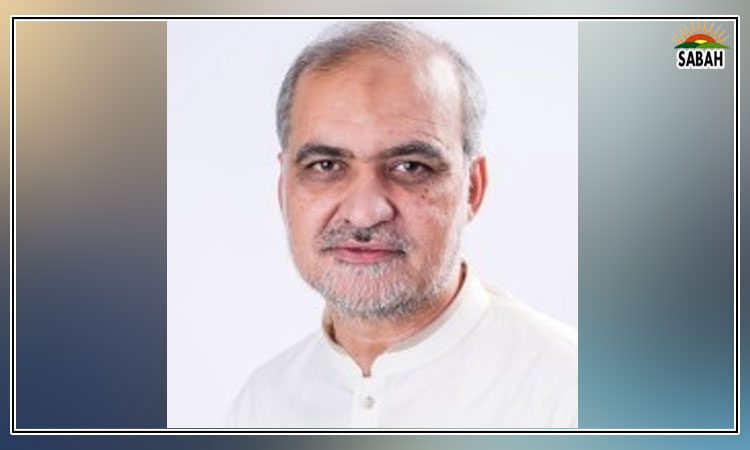

Post-Fund deal…Rashid Amjad

THE euphoria that greeted the IMF Staff-Level Agreement on a new nine-month Stand-by Arrangement (SBA) of $3 billion was understandable. The economy was facing near-certain default and was in the midst of a deep slump, with little or no growth last financial year.

This was accompanied by unprecedented inflation of 35 per cent, causing the IMF to insist on hiking interest rates further to an all-time high of 22pc the highest in living memory. Poverty levels have soared and left five million workers actively seeking and not finding jobs.

That it was a self-inflicted wound in large part was brought home when the prime minister rightly took credit for the last-minute agreement as the head of the economic team that had failed to achieve this over six months mainly due to his misplaced confidence sat next to him. Indeed, the economy overall has been very poorly managed over the last year.

The first thing to note about the IMF SBA is that only the first tranche of $1.1bn will come in later this month after the agreement is approved by the IMF Board. The second and third tranches will only be forthcoming at three-month intervals after a joint review and the IMFs go-ahead.

So, even if the threat of default has eased temporarily and it should open flows from multilaterals and friendly countries of another $5bn to $6bn, Pakistans troubles are far from over.

The country faces an overall foreign exchange financing gap of near $24bn this year. This makes it imperative that this SBA must not end halfway as the last and many before have done.

Critically, first and foremost, the IMF will examine in three months time whether we have fully removed existing administered import controls and stopped our habitual fiddling with the exchange rate.

Even in a slightly improved foreign exchange reserve position, this is a very challenging task and involves some difficult choices. If we go through this policy change as agreed, we will end up with an unaffordably high exchange rate, despite its current drop, to balance out the rising import demand that will follow in the new import regime in the face of falling export earnings and remittances.

To stem the rising tide of imports, the IMF agreement requires us to impose very tight demand suppression measures. These include continuing with a high interest rate regime and implementing steep increases in tax rates as announced in the budget on high-income earners and higher sales tax on many goods, together with deep cuts in development expenditure.

These steps, if fully implemented, will bring the fiscal deficit to a more prudent 4pc. However, these strong stabilisation measures will also mean continuing with very little or no economic growth, rising unemployment and further pressure on rising prices.

But will this tightening of aggregate demand suppress import demand sufficiently to allow the demand-driven exchange rate to fluctuate within an affordable band, one that does not result in such high import prices that inflation goes through the roof? My own assessment is that these measures will not be enough.

If we really wish to ensure that the IMF deal holds, what is required is for the large banks and major importers (in all sectors) to acknowledge the harsh macroeconomic realities in which they must operate and adjust their requirements accordingly rather than always maximising narrow self-interest as they are wont to do.

What the country needs is a Charter of the Economy endorsed by the private sector (or its representative bodies) that clearly spells out the policy framework required to increase its competitiveness and exports without the usual wish list of more protection and unaffordable subsidies.

The troubling question on everyones minds is whether the IMF deal will break the back of this unprecedented, entrenched inflation. Given that the current price spiral is in large part driven by cost-plus pricing by sellers to protect their incomes, it will take time for inflation to come down. This will require that direct income support for the poorest households be suitably increased.

The real task, however, of carrying through far-reaching structural reforms to ensure sustainable growth will fall on the new government that will take over in November this year. They should start preparing for how to successfully conclude the current IMF deal and agree on the contours of the next IMF programme, which we will in all probability still need.

For this, we require an economic team in both the interim and new government with professional competence, vigilance and leadership to maintain confidence of financial markets. Hopefully the selectors will find them!

Courtesy Dawn