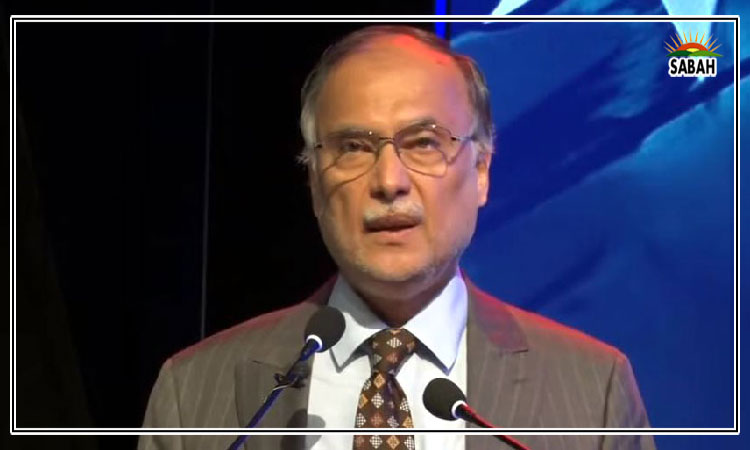

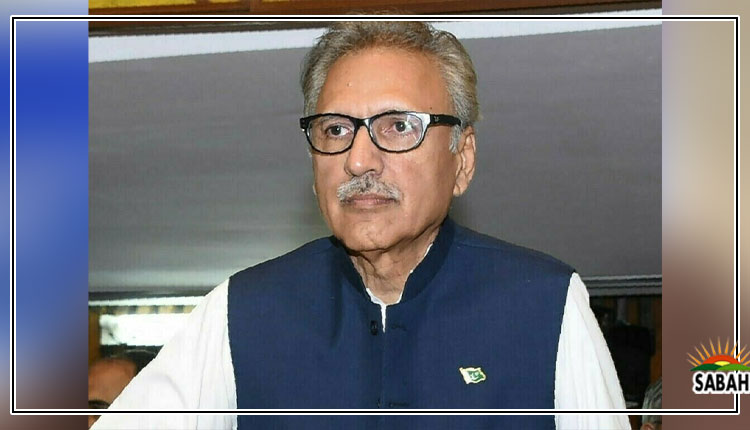

President Alvi rejects three separate representations filed by the State Life Insurance Corporation of Pakistan

ISLAMABAD, May 03 (SABAH): President Dr. Arif Alvi has rejected three separate representations filed by the State Life Insurance Corporation of Pakistan (SLIC) as maladministration was established on its part in three cases where it had repudiated insurance claims of the complainants on the ground that the insurance policyholders had pre-insurance ailments which they had willfully hidden at the time of obtaining the policy.

President Dr. Arif Alvi directed SLIC to pay insurance claims worth over Rs 3.2 million to three complainants and report compliance to Wafaqi Mohtasib within 30 days. The President gave these directions while rejecting three separate representations filed by SLIC against the decisions of the Wafaqi Mohtasib. As per details, Mst Samina Shahzadi, Mr Muhammad Mehfooz, and Mst Seeta (the complainants) stated that their family members had obtained insurance policies from SLIC worth Rs 2.9 million, Rs 198,290, and Rs 192,000 respectively. After the deaths of policyholders, SLIC refused to pay the death insurance claims to complainants. Feeling aggrieved, the complainants separately approached the Wafaqi Mohtasib, which passed orders in their favour. SLICP, then, filed separate representations with the President against the decisions of the Mohtasib, which the President also rejected.

In the case of Mst Samina Shahzadi, President Dr. Arif Alvi observed that her deceased husband (Muhammad Saeed Ahmed) had died due to COVID-19, as reported by ABWA Hospital and Research Centre, Faisalabad, and not due to the pre-insurance ailment of brain tumour as claimed by SLIC. In the case of Mr Muhammad Mehfooz, the President pointed out that the policy was issued to his sister (Mst Chand Bibi) on 26.12.2018 and she died on 19.12.2021 after the expiry of a period of over 3 years & 7 months. Similarly, he noted that the policy was issued to the husband of Mst Seeta (Jodho Mal) on 31.12.2018, who later died on 17.03.2021 after the expiry of a period of over 2 years & 2 months. The President highlighted that as per Section 80 of the Insurance Ordinance, 2000, no policy of life insurance effected after the commencement date of the Ordinance, could be called in question after the expiry of the two-year period on the ground that a statement made in the proposal for insurance or in any report of the medical officer was inaccurate or false. He further observed that in both cases, the Confidential Reports of the Field Officers of SLIC had declared the policyholders as healthy at the time of issuance of the policy and had categorically stated that they knew the deceased since birth. The President concluded that since maladministration on the part of SLIC stood established in all the three cases, therefore, representations were being rejected and SLIC was directed to pay the death insurance claims to the complainants.