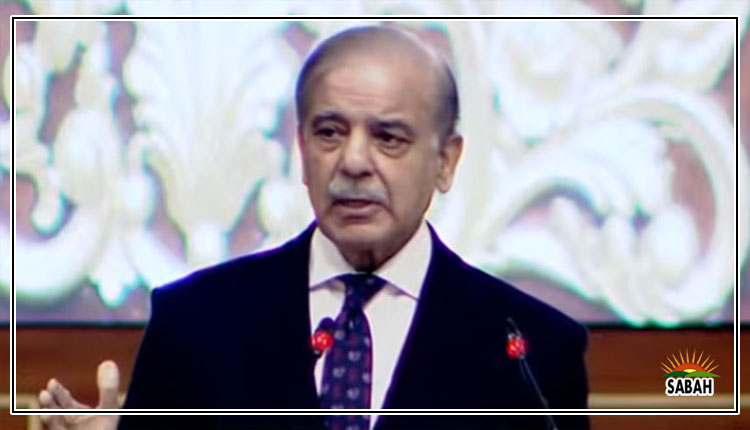

K-P: charter of demands… Dr Syed Akhtar Ali Shah

The province of Khyber-Pakhtunkhwa is facing acute shortage of funds and narrow financial space to carry on socio-economic development. Most of the revenues are derived from the federation under a mechanism provided in the Constitution.

The National Think, having analysed the statements of the Caretaker Chief Minister and other documents, considers that the realisation of the budget programmes is dependent on the due share of K-P in national income, releases under the National Finance Commission award, revenues from net hydel profit, gas and arrears of net hydel profits (NHP) under the methodology of AGN Qazi.

In this context the federal government has time and again assured the K-P government that they would resolve the NHP issue and pay the dues of the provinces according to the AGN Qazi formula. The key outcomes included the fact that the uncapped NHP, as determined and transmitted from NEPRA, got notified on March 7, 2016, provisioning the payment of the NHP to the K-P government at the revised rate of Rs1.15 per KWh (of the electricity production in K-P). In addition, out of the total share of Rs70 billion on account of uncapped NHP arrears, actual disbursement of Rs58.1 billion had been made to the K-P government leaving a balanced amount of Rs11.9 billion in 2019-2020. On the other hand, many sources suggest that the provinces NHP arrears since 2015 have jumped to Rs900 billion.

The Caretaker Chief Minister is himself on record that the federal government has allocated a grant of only Rs60 billion for newly merged districts for fiscal year 2022-23 against a minimum current budget requirement of Rs89.5 billion for salary and non-salary expenditures. Similarly, Rs50 billion has been allocated for development projects in the merged districts, out of which only Rs5.5 billion have been released during the first six months of the year. Moreover, the share of K-P fixed in the NFC award is not being given, while Rs61.89 billion are also due with the federal government on account of NHP.

In this context, the total expenditure of the K-P government is estimated at Rs1,332 billion, including Rs1,109.1 billion for the settled districts and Rs222.9 billion for the Newly Merged Areas (NMAs). Expenditure in the NMAs includes a Rs6 billion grant from the provincial government out of its own resources for the Accelerated Implementation Plan (AIP), in line with the decision taken for all provinces to contribute 3% of the total divisible pool share to the development of merged districts.

This years total estimated receipts are Rs1,332 billion. Federal Transfers including Federal Tax Assignment, 1% War on Terror, and Straight Transfers are budgeted at a total of Rs670.5 billion.

Besides, Rs61.89 billion are estimated against NHP and Provincial Own Receipts are projected at Rs85 billion. Grants from Federal Government for NMAs are estimated at Rs208.7 billion, with a transfer of Rs34.6 billion from the divisible pool for the NMAs. Finally, Foreign Project Assistance is budgeted at Rs93.2 billion.

For FY 2022-23, total receipts are estimated at Rs1,332 billion for the entire K-P province. This includes Rs570.8 billion as Federal Tax Assignment, Rs85 billion as Provincial Own Revenue Receipts, Rs61.89 billion as NHP, Rs68.59 billion as 1% War on Terror transfer, and Rs208.7 billion as grants from the Federal Government (to fund the budget of the NMAs, prior to the settlement of the NFC award).

Royalty on Oil and Gas is payable by the exploration and production companies to the Government at the rate of 12.50% of the wellhead value, 2% of which is retained by the Federal Government and the rest is payable to the Provincial Government which should be paid without delay.

Gas Development Surcharge is the margin available to the Government caused by the difference in the sale price for consumers as determined by OGRA and the prescribed price for Gas Companies on the basis of their fixed return, as defined in the Natural Gas (Development Surcharge), Ordinance, 1967. The prescribed price of Sui Northern Gas Pipeline Ltd (SNGPL) and Sui Southern Gas Company Limited (SSGCL) is based on wellhead price of gas, excise duty at wellhead, operation and maintenance cost, depreciation, and returns of gas company (17.5% SNGPL and 17% SSGCL) on assets. Royalty and Gas Development Surcharge are inversely proportional to each other. In case, the wellhead value is more, there will be more royalty but less Gas Development Surcharge and vice versa. As per the 7th NFC Award, Each of the provinces shall be paid in each financial year as a share in the net proceeds to be worked out based on the average rate per MMBTU of the respective Province. The average rate per MMBTU shall be derived by notionally clubbing both the royalty on Natural Gas and Development Surcharge on Gas. Royalty on Natural Gas shall be distributed in accordance with clause (1) of Article 161 of the Constitution whereas the Development Surcharge on Natural Gas would be distributed by making adjustments based on this average rate.

Excise duty on oil is not paid to the province, as the rate has not been determined yet. K-P accounts for more than 50% of the national oil production which means it absorbs the highest loss from the unavailability of this duty, which is required to be worked out.

The Federal Government collects Petroleum Development Levy on different petroleum products. It is budgeted at Rs750 billion for FY 2022-23. This collection is not distributed among the provinces as it is excluded from the Federal Divisible Pool of the NFC, which is a violation of the rights of the provinces.

Since the issue of fiscal federalism has been settled through the Constitution, it has to be followed in letter and spirit for social development and to avoid acrimony.

Courtesy The Express Tribune, February 15th, 2023.