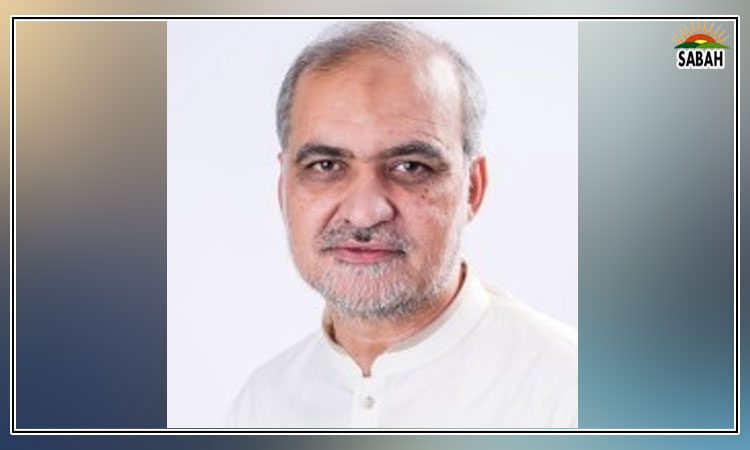

Pakistan heading in right direction, there is no risk of default: Ishaq Dar

ISLAMABAD, Dec 28 (SABAH): Finance Minister Ishaq Dar reiterated on Wednesday that Pakistan will not default on international payments, as the government has arranged the entire requirement for $31-32 billion for the ongoing fiscal year 2023.

The funds are required to finance the current account deficit (CAD) and repay foreign debt.

It may be noted that here on the other day the Pakistan Stock Exchange (PSX) had again taken a turn for the worse, after the previous day’s handsome recovery, as concerns over the country’s economic situation and the fate of the International Monetary Fund’s (IMF) loan programme had caused jitters in the market.

Adding to the investor woes, a persistent political uncertainty following Pakistan Tehreek-e-Insaf (PTI)’s announcement of the dissolution of Punjab and Khyber-Pakhtunkhwa (K-P) assemblies and the Pakistani rupee’s gradual fall had further dented interest in stock buying.

Stocks closed lower due to rupee instability and forex crisis impacting industries,” MD Arif Habib Corp Ahsan Mehanti had said. “Political uncertainty, projections of higher inflation in December 2022 and concerns over the delay in IMF’s review in the wake of disagreement on petroleum levies and the budgeted flood losses played the role of catalysts in the bearish close of the market,” he had added.

At close on Tuesday, the benchmark KSE-100 index had recorded a decrease of 352.25 points, or 0.88%, at 39,802.91. Topline Securities, in its report, said that the lack of confidence in Pakistan’s economy and the delayed IMF programme led to profit-taking as the market touched an intra-day low of 449 points.

Addressing a ceremony at PSX, Ishaq Dar stressed that he had the country’s economy under control.

“Pseudo intellectual…and people with vested interest have been creating propaganda that Pakistan will default, while it is not the case,” he said.

Sharing the facts, he maintained that Pakistan’s debt-to-GDP ratio stands at 72% at present, “while the ratio in case of the US stands at 110%, Japan’s 257%, [and] there are over dozens developed countries, including [the] UK which have a debt-to-GDP ratio of over 100%, but no one says they would default”.

In an over 35-minute online address to the PSX, Senator Dar slightly touched upon the grave outstanding issues between the government and the IMF and winded up the subject in a one-line statement by saying that “we will complete the ongoing IMF programme [worth $6.5 billion].”

He, however, spent some time on expressing his dislike towards global lending institutions by saying that “we should get rid of the multilateral creditors. Our ultimate goal is to get rid of them.”

“We are once again stuck in a tough economic situation,” he admitted and said in the same breath that Pakistan is a resilient nation. “It would survive the ongoing crisis and return to progressing path,” he added.

Pointing out the causes of the ongoing foreign exchange reserves crisis and fault lines in the economy, the finance minister, without naming Afghanistan, said that it is not only the US dollar that is being smuggled to the neighboring country but wheat and fertiliser have also been smuggled from Pakistan.

He informed that law enforcement agencies are conducting a crackdown against the smugglers and the issue would be resolved soon. “Pakistan has a bright future,” he said and added the nation has come out of such crisis time and again in the past, including in 2008 and “2013 when there was a situation…the forthcoming elected government would declare Pakistan as a default state within six to seven months after the then elections, but we [managed’ to take off.”

He also agreed on cutting the high key policy rate of the central bank, which stands at a 23-year high at 16% at present and strengthening the rupee against the US dollar. “Pakistan’s foreign exchange reserves would be at the much-improved level when we close the current fiscal year on June 3, 2023,” he assured.

Earlier this week, PTI Chairman and former premier Imran Khan had claimed that the country was heading towards a default with each passing day under the “imported government”.