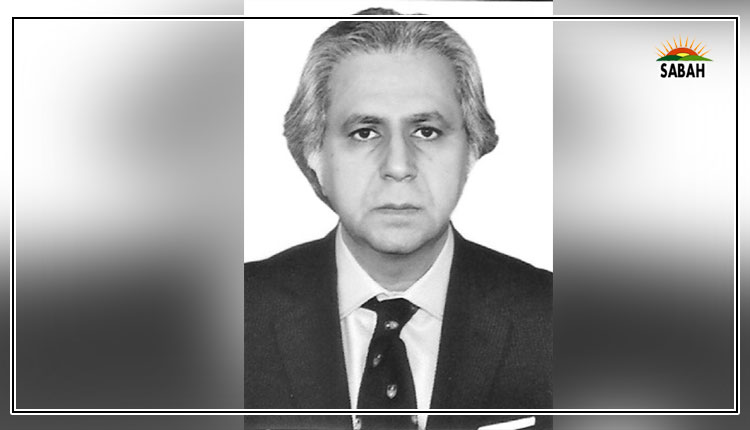

Perception: Tool to curb inflation….Dr Kamal Monnoo

The current economic impasses are already signalling gloom and doom amongst young Pakistani job seekers. The statistics revealed that almost 1 million young brains left Pakistan this year to seek prospects abroad and that nearly half hailed from Punjab; ironically the very province which only a few years back ranked the highest in the country on investment, growth, and employment generation. Almost 3 million young employable youngsters enter the job market every year and are finding it increasingly difficult to find meaningful opportunities.

The general perception about the countrys economic future is fast dwindling and something that needs to be quickly arrested and restored. In the modern-day world perception is an extremely powerful tool that directly influences outcomes and events. It is something that has been recognised by economists for a long time and perhaps one of the few elements of behavioural economics that all leading economists agree upon from Adam Smith to Hayek to Keynes to Schumpeter to Friedman and todays Krugman and Stiglitz. It is only of late with the development of information technology and the coming to light of some very powerful social and electronic media platforms that perception is being moulded or even orchestrated to achieve desired political and economic goals. The power of perception on markets is growing with each passing day where a positive perception invariably leads to positive results. Even in ones personal life, perception has a key role in determining success. Professor James Higgins in his world-famous book, Born to Win, explains how managing desired short-term and long-term individual goals can be successfully attained by consistently keeping them in visible sight (in written or any other form)so that the mind and actions do not drift away from them and for the inspiration to remain kindled all the timeand by defining them in practically do able timelines. His classic example is of how to say a college professor can end up buying a decent-sized yacht in his potential income in a period of give or take 5 years. Now obviously if one writes down that he/she would like to replace Elon Musk at Tesla in the next 5 years, that is probably not going to happen!

It is however important though to use perception both, effectively and positively. For example, as the developed economies are displaying today, forming the right perceptions can be an important tool in taming inflation. Likewise, one is sure that given the rapid development of electronic and social media in Pakistan, unleashing the desired perceptions on forward pricings could be a very useful instrument in tackling hyperinflation or even stagflation, something that maybe we are witnessing today in Pakistan. Meaning, say if a family was to make an important domestic decision on buying a new car and somehow they were to be convinced through social media that the prices of cars are likely to come down over the next quarter, there exists more than a 75 percent probability that they will end up postponing their purchase by at least 3 months. Now spread this outcome on a mass collective basis and what one will see is that the prices of automobiles will in fact drop due to a drop in demand and an increase in competition within the automobile industry. We have seen this happen in recent years in quite a few economies and especially in Brazil and South Korea.

And it is for this very reason, when I was recently informally consulted by some government functionaries on should interest be going up further in Pakistan, my advice was that whereas, I do understand the inclination to use monetary tools to curb inflation, raising interest further at this stage in the economy would be a grave mistake. Because, not only will it do little to affect market prices, but also instead a) further strangulate supply-chain; b) put us at a further disadvantage on the cost-of-capital comparison with our South Asian neighbours, and c) retard investment, thereby compounding the prevailing economic slowdown and employment contraction. Rather than raising the interest rate by another 100 basis points, a good alternative would be to instead engage with powerful influencers, bloggers, and popular IT platforms to signal a likelihood of looming price drops, and once the notion gains traction the market will automatically respond with the desired results. They were not impressed since the same week the interest rates were raised again!

Courtesy The Nation