Accountability court suspends arrest warrants of Ishaq Dar in the assets beyond means case filed against him by NAB

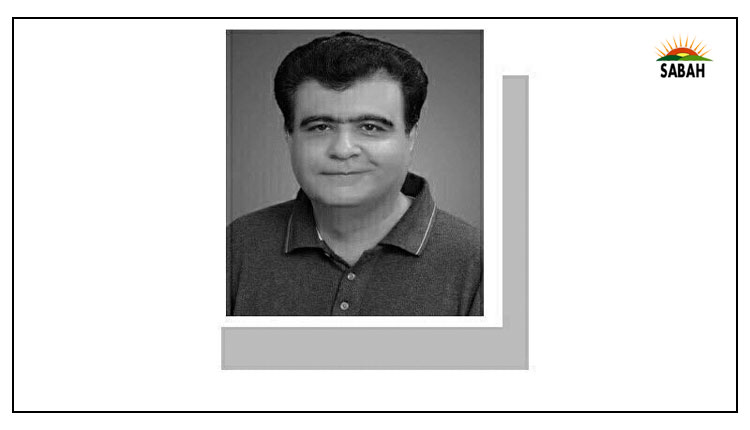

ISLAMABAD, Oct 07 (SABAH): Accountability court Islamabad judge Muhammad Bashir on Friday suspended the arrest warrants of Minister for Finance and Revenue Senator Mohammad Ishaq Dar in the assets beyond means case filed against him by the National Accountability Bureau (NAB).

The cancellation orders were issued after the minister appeared before Accountability court judge Muhammad Bashir with his lawyer Qazi Misbah. The court also directed the minister to submit surety bonds of Rs1 million.

At the outset of the hearing, Misbah asked the court to permanently cancel his client’s arrest warrant and the order to confiscate his assets.

The lawyer told the court that it had issued the arrest warrants so Dar appears before the court, adding that they should be cancelled now as the minister is present before the court.

“Did NAB also issue arrest warrants of Ishaq Dar,” Judge Bashir asked the anti-corruption watchdog’s prosecutor.

Anti-graft’s body responded in the affirmative but clarified that the warrants were suspended.

“What is your point of view now, should the warrants be cancelled or not?” asked the judge.

At this question, the NAB prosecutor supported the cancellation of warrants, adding that they were issued to ensure Dar’s appearance in the case.

The judge then remarked that it will have to indict Ishaq Dar once again as a supplementary reference has also been filed against him.

To this, Dar’s lawyer stated that they will give arguments on the supplementary reference.

Before adjourning the case till October 12, the court issued notices to NAB over the application filed against the confiscation of Dar’s property and permanent exemption from appearance.

The court has ordered NAB to present its arguments at the next hearing on both applications.

Meanwhile talking to media persons after appearing before the court, Finance Minister Ishaq Dar reiterated his government’s commitment to strengthen country’s economy by taking all possible measures. He said no one will be allowed to control rupee’s value artificially.

The Minister said by every passing day rupee’s value is improving, however, he regretted that the previous government devalued Pakistan’s currency artificially.

The Minister urged all political parties not to do politics over economy. He said charter of economy is need of the hour and a consensus should be developed in this regard.

Ishaq Dar said with improved rupee’s value our foreign debt has decreased by 2600 billion rupees within few days.

The Minister said the case of not filing tax returns against him is baseless and just aimed at taking political revenge.

Ishaq Dar warned Moody’s Investor Service that he would give a “befitting” reply in a meeting with its officials next week if the agency did not reverse the downgrade of Pakistan’s sovereign credit rating.

“They (Moody’s officials) have to meet me. I told them if you don’t [reverse] this, I will give you a befitting response in our meeting next week,” he said.

A day earlier, Moody’s cut Pakistan’s sovereign credit rating by one notch to Caa1 from B3, citing increased government liquidity and external vulnerability risks, following the devastating floods that hit the country earlier this year.

“The outlook remains negative,” said the New York-based rating agency, adding that the floods had exacerbated Pakistan’s liquidity and external credit weaknesses and vastly increased social spending needs, while government revenue is severely hit.

Debt affordability, a long-standing credit weakness for Pakistan, will remain extremely weak for the foreseeable future. The downgrade has pushed the country into the C-category after seven years, i.e. March 2015.

Ishaq Dar said he had spoken to the agency’s officials and told them that they “should not have done it”.

Moody’s should have consulted Pakistan prior to the downgrade, the finance minister said, adding that there was “no cause for worry” as rating agency Fitch had also downgraded the United Kingdom earlier this week.

“The main work of these rating agencies is related to bonds. We floated $500 million bonds in April 2014 and we had 14 times oversubscription.

“We have given our response. I have worked in international organisations too. It was impossible for them (Moody’s) to undo [the downgrade],” he acknowledged, but reiterated that he would give a “befitting response” to the agency.

Meanwhile the Pakistani government in a statement on Friday said Moody’s carried out rating action “unilaterally without prior consultations and meetings with teams from the Ministry of Finance and State Bank of Pakistan”.

Following Moody’s action, the finance ministry held two meetings with the agency’s team over the past 24 hours, sharing data and information which clearly show a picture contradicting Moody’s rating action.

The ministry said the “government policies over the last few months have helped in fiscal consolidation” and the government had adequate liquidity and financing arrangements to meet its external liabilities. The continuation of the IMF programme was based on the confirmation and confidence in country’s ability to maintain the fiscal discipline, debt sustainability and its ability to discharge all its domestic and external liabilities, it said.

It said Moody’s estimates translating economic losses into fiscal deficit was also contested as uptick in urgent current expenditure is being met through re-allocations and re-appropriations of budgeted funds thus mitigating the risk of rising deficit. On the revenue front, the increase in nominal GDP is likely to compensate for any dip in revenues.

“The impression of restructuring of Pakistan’s debt is refuted unequivocally as currently no such proposal is under consideration or is being pursued as has been categorically stated by the finance minister,” it said.