Circular debt in power sector jeopardizes energy security & energy affordability in the country: Experts

ISLAMABAD, July 25 (SABAH): The power sector of Pakistan has been badly incapacitated by the grave issues of circular debt, which is reflected in the continuous electricity tariff hikes and skyrocketing fuel price adjustments.

Not only the National Electric Power Regulatory Authority (NEPRA) has approved Rs11 per unit tariff hike for the high-end consumers on the request of the Ministry of Energy, the “flat slab rates” mechanism also has been implemented, burdening the low electricity consumers substantially.

This was discussed during a meeting held at the Institute of Policy Studies (IPS), Islamabad to discuss the pitfalls of the power sector of Pakistan, impacts of circular debt, resolution mechanism, and assess the roadmap to address the issues.

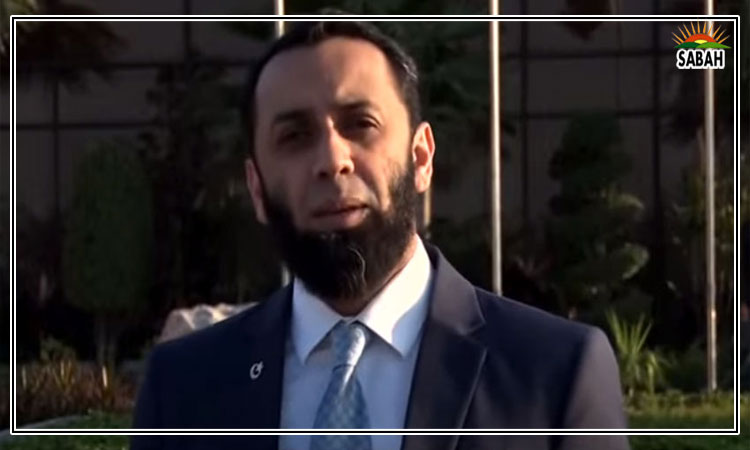

The meeting was co-chaired by Khalid Rahman, chairman IPS, and Mirza Hamid Hassan, chair IPS Energy Steering Committee and former federal secretary, Ministry of Water and Power.

Ashfaq Mehmood, former federal secretary, Ministry of Water and Power, AmeenaSohail, member board of directors, IESCO, and legal advisor to NEPRA, Syed Akhtar Ali, energy expert, Raja Kamran, president Council of Economic and Energy Journalists and others participated in the meeting to assess the power situation of the country and its impacts.

It was pointed out in the discussion that Pakistan is among the countries with some of the lowest indexes of energy affordability, which has potential negative impacts on the overall economic progression. Primarily, the setting up of furnace oil, RLNG and RFO based generation facilities over the decades led to dependence on expensive fossil fuels, which caused the snowballing of fiscal deficit of payments in the power sector.

The speakers observed that circular debt, the core issue of the power sector, has jeopardized energy security and energy affordability in the country. It is a well-considered fact that Pakistan’s electricity generation cost has jumped up to 160% since June last year and the government is now incapable of providing subsidies to consumers.

While the factors attributed to the ballooning circular debt were identified as the snowballing capacity payments, governance issues, inefficiencies in the distribution utilities, and fluctuating prices of fossil fuels in the international market, it was also mentioned that the burden of the debt was being transferred heavily to the end-consumers.

The after-effects of the new tariff hikes indicate that the applicable base tariff for those consuming 100-200 units would be Rs18.95, while those consuming 201-300 units would be charged Rs22.14, and the rate for 301-400 units has been increased to Rs 25.53, which previously stood at Rs11.74, Rs13.81, and Rs21.23. Along with that, fuel price adjustments subject to price fluctuations of petroleum products would also be charged from the consumers.

The circular debt pile currently stands at Rs4700billion, and the speakers maintained that the contracts made on the “take or pay” mode are the primary factors for its accumulation.

The speakers highlighted that a focused approach is much needed to control the outburst of the circular debt. They observed that management restructuring of the power distribution companies (DISCOs), energy transition towards renewable sources, competitive bidding in generation facilities, enhancing the technical efficiencies, and dividing the DISCOs into smaller units are much-needed interventions for the power sector of the country.